Dow Jones Index Importance in World of Finance - Historical Chart, Components, and More

Long-term chart of Dow Jones Index - Dow Jones Industrial Average (since 1900) is available on this page, plus its components, description and more.

Dow Jones Index or to be exact in the name, the Dow Jones Industrial Average, also known as the Dow Jones, the Industrial Average, the Dow 30, or simply the Dow, is one of the oldest and mostly closely-watched stock indices all over the world.

It shows how 30 large, publicly owned companies based in the United States have traded during a standard trading session in the New York Stock Exchange. The Industrial portion of the name is largely historical, as many of the modern 30 components have little or nothing to do with traditional heavy industry.

Provider and Calculation of Index

Dow Jones Index is calculated and published by Dow Jones Indexes (www.djindexes.com), who is a leading full-service index provider that develops, maintains and licenses indexes for use as benchmarks and as the basis of investment products. Dow Jones Indexes offers more than 130,000 equity indexes as well as fixed-income and alternative indexes, including measures of hedge funds, commodities and real estate.

Dow is price-weighted, and to compensate for the effects of stock splits and other adjustments, it is currently a scaled average. The value of the Dow is not the actual average of the prices of its component stocks, but rather the sum of the component prices divided by a divisor, which changes whenever one of the component stocks has a stock split or stock dividend, so as to generate a consistent value for the index.

Importance of Index for Financial Audiance

Along with the NASDAQ Composite, the S&P 500 Index, and the Russell 2000 Index, the Dow is among the most closely-watched benchmark indices tracking targeted stock market activity. Although Dow compiled the index to gauge the performance of the industrial sector within the American economy, the index's performance continues to be influenced by not only corporate and economic reports, but also by domestic and foreign political events.

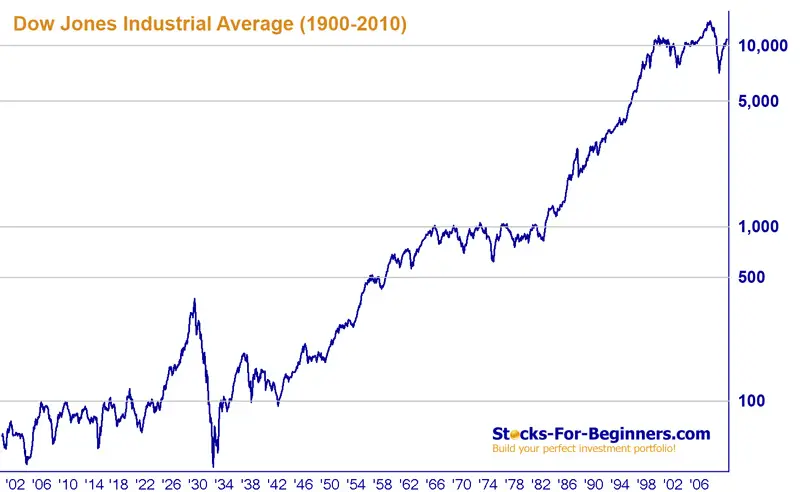

Index Historical Chart

If you look at the 110 years historical chart of Dow, you can see, that the major volatility and drop in the value of the index was in stock market crash of 1929.

Index Components

The Dow 30 index components are shown in table below as of 05/05/2010.

| Company | Symbol | Industry | Date Added |

|---|---|---|---|

| 3M | MMM | Conglomerate | 1976-08-09 (as Minnesota Mining and Manufacturing) |

| Alcoa | AA | Aluminum | 1959-06-01 (as Aluminum Company of America) |

| American Express | AXP | Consumer finance | 1982-08-30 |

| AT&T | T | Telecommunication | 1999-11-01 (as SBC Communications) |

| Bank of America | BAC | Banking | 2008-02-19 |

| Boeing | BA | Aerospace and defense | 1987-03-12 |

| Caterpillar | CAT | Construction and mining equipment | 1991-05-06 |

| Chevron Corporation | CVX | Oil & gas | 2008-02-19 |

| Cisco Systems | CSCO | Computer networking | 2009-06-08 |

| Coca-Cola | KO | Beverages | 1987-03-12 |

| DuPont | DD | Chemical industry | 1935-11-20 (also 1924-01-22 to 1925-08-31) |

| ExxonMobil | XOM | Oil & gas | 1928-10-01 (as Standard Oil) |

| General Electric | GE | Conglomerate | 1907-11-07 |

| Hewlett-Packard | HPQ | Technology | 1997-03-17 |

| The Home Depot | HD | Home improvement retailer | 1999-11-01 |

| Intel | INTC | Semiconductors | 1999-11-01 |

| IBM | IBM | Computers and technology | 1979-06-29 |

| Johnson & Johnson | JNJ | Pharmaceuticals | 1997-03-17 |

| JPMorgan Chase | JPM | Banking | 1991-05-06 (as J.P. Morgan & Company) |

| Kraft Foods | KFT | Food processing | 2008-09-22 |

| McDonald's | MCD | Fast food | 1985-10-30 |

| Merck | MRK | Pharmaceuticals | 1979-06-29 |

| Microsoft | MSFT | Software | 1999-11-01 |

| Pfizer | PFE | Pharmaceuticals | 2004-04-08 |

| Procter & Gamble | PG | Consumer goods | 1932-05-26 |

| Travelers | TRV | Insurance | 2009-06-08 |

| United Technologies Corporation | UTX | Conglomerate | 1939-03-14 (as United Aircraft) |

| Verizon Communications | VZ | Telecommunication | 2004-04-08 |

| Wal-Mart | WMT | Retail | 1997-03-17 |

| Walt Disney | DIS | Broadcasting and entertainment | 1991-05-06 |

Historical Components

Dow has 30 components today, but it wasn't always like that. The Dow was initially containing 11 stocks (nine of which were railroad issues). If you are interesting in history development of the index, you should check historical components of DJIA as a separated PDF file.

Where To Go Next?

Dow Jones Index - The Oldest And Most Closely-Watched Stock Index In The World

Dow Jones Index shows how 30 large, publicly owned companies based in the United States have traded during a standard trading session on the New York Stock Exchange.

S&P 500 Index

The S&P 500 Index is a free-float capitalization-weighted index, which includes 500 large-cap common stocks traded actively in the United States.

Nasdaq 100 Index

All about the Nasdaq 100 index, most often and worldwide used benchmark for stocks in technology sector.

Nasdaq Composite Index

Nasdaq Composite Index is a stock market index out of more than 2,500 U.S. and non-U.S. technology and growth companies listed on the NASDAQ stock market.

FTSE Index

The FTSE index is a share index of the 100 most highly capitalized UK companies listed on the London Stock Exchange and a measure of UK business prosperity.

Nikkei Index

Nikkei index is most widely quoted price-weighted average of 225 largest Japanese companies traded on the Tokyo Stock Exchange.

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

Stock Market Today - Live Real-Time Streaming Graphs and Quotes

Interested in what is happening on the stock market today? Check our real-time charts of the most popular stocks, indices, currencies, and commodities.

Online Stock Brokers - Reviews, Ratings, Comparison, and More

Selecting online stock broker is an important initial step of every trader or investor. Take smart decision with reviews, tools and articles published here.

Written by: Goran Dolenc

Back from Dow Jones Index to Home Page

Back from Dow Jones Index to Best Online Trading Site Home Page