FTSE Index

The FTSE Index is a share index of the 100 most highly capitalized UK companies listed on the London Stock Exchange and a measure of UK business prosperity.

The FTSE index (also called FTSE 100 index, FTSE 100, FTSE, or the "footsie") is a share index of the 100 most highly capitalized UK companies listed on the London Stock Exchange. It is the most widely used of the FTSE Group's indices, and is frequently reported on UK news bulletins as a measure of business prosperity, because it represents about 80% companies of the market capitalization of the whole London Stock Exchange.

Provider

The FTSE index is maintained by the FTSE Group, an independent company which originated as a joint venture between the Financial Times and the London Stock Exchange.

Calculation Of Index

Trading on the London Stock Exchange lasts from 08.00 - 16.29 (when the closing auction starts), and closing values are taken at 16.35. FTSE index is calculated in real time and published every 15 seconds. Weighting of individual stocks in the index depend on the total market capitalization of the companies, which is adjusted with the Free float Adjustment factor - proportion of shares that is floated as a percentage of issued shares and then its rounded up to the nearest multiple of 5% for calculation purposes.

Selection Of Index Components

The constituents of the FTSE index are determined quarterly according to their market capitalization. Component companies must meet a number of requirements set out by the FTSE Group, including having a full listing on the London Stock Exchange and meeting certain tests on nationality, free float, and liquidity. Companies listed on FTSE index must by law include the abbreviation 'plc' at the end of their name, indicating their status of public limited company.

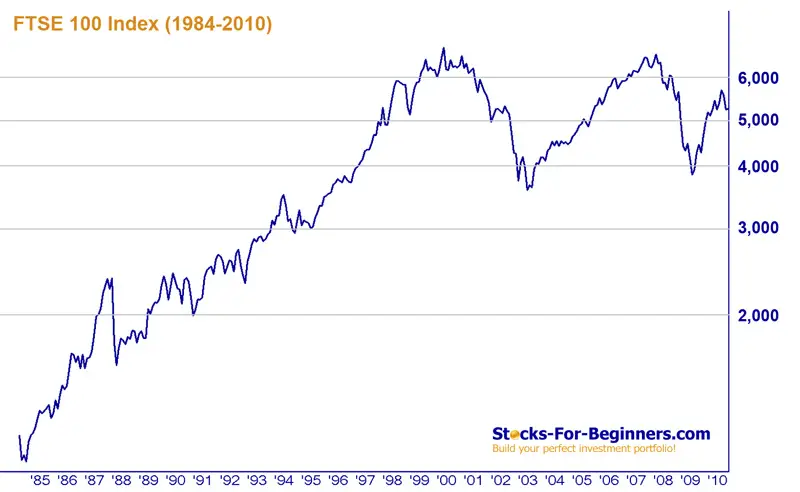

Index Historical Chart

The FTSE index is published since 3 January 1984 with a base level of 1000; the highest value 6950.60 was reached on 30 December 1999. The latest minimal value of the index was reached in March 2009, when index reached the 3460.71 level.

Index Sector Allocation

The FTSE index has the following sector allocation (as of 6/16/2010):

- Financials: 21.54%

- Oil&Gas: 18.48%

- Basic Materials: 13.18%

- Consumer Goods: 12.57%

- Health Care: 8.96%

- Consumer Services: 8.76%

- Telecommunications: 6.75%

- Industrials: 4.71%

- Utilities: 4.01%

- Technology: 1.03%

- Engineering: 0.01%

Index Components

The FTSE index components shown in table below are sorted by weightings and valid as of 6/16/2010.

| Company | Symbol | Sector | Weight |

|---|---|---|---|

| HSBC Holdings PLC | HSBA | Financials | 8.38% |

| RDS A PLC | RDSA | Oil & Gas | 5.66% |

| Vodafone Group PLC | VOD | Telecommunications | 5.51% |

| BP PLC | BP. | Oil & Gas | 4.95% |

| Glaxosmithkline PLC | GSK | Health Care | 4.65% |

| Rio Tinto PLC | RIO | Basic Materials | 3.74% |

| RDS B PLC | RDSB | Oil & Gas | 3.45% |

| Astrazeneca PLC | AZN | Health Care | 3.30% |

| British American Tobacco PLC | BATS | Consumer Goods | 3.21% |

| BHP Billiton PLC | BLT | Basic Materials | 3.13% |

| BG Group PLC | BG. | Oil & Gas | 2.75% |

| Barclays PLC | BARC | Financials | 2.68% |

| Anglo American PLC | AAL | Basic Materials | 2.62% |

| Standard Chartered PLC | STAN | Financials | 2.49% |

| Tesco PLC | TSCO | Consumer Services | 2.30% |

| Diageo PLC | DGE | Consumer Goods | 2.08% |

| Unilever PLC | ULVR | Consumer Goods | 1.83% |

| Reckitt Benckiser Group PLC | RB. | Consumer Goods | 1.74% |

| Sabmiller PLC | SAB | Consumer Goods | 1.72% |

| Xstrata PLC | XTA | Basic Materials | 1.67% |

| Lloyds Group PLC | LLOY | Financials | 1.60% |

| Imperial Tobacco Group PLC | IMT | Consumer Goods | 1.44% |

| National Grid PLC | NG. | Utilities | 1.30% |

| Centrica PLC | CNA | Utilities | 1.10% |

| Prudential PLC | PRU | Financials | 1.02% |

| BAE Systems PLC | BA. | Industrials | 0.84% |

| Rolls-Royce Group PLC | RR. | Industrials | 0.82% |

| BT Group PLC | BT-A | Telecommunications | 0.79% |

| Compass Group PLC | CPG | Consumer Services | 0.78% |

| Tullow PLC | TLW | Oil & Gas | 0.77% |

| Scotish & Southrn Energy PLC | SSE | Utilities | 0.75% |

| Aviva PLC | AV. | Financials | 0.70% |

| WPP PLC | WPP | Consumer Services | 0.64% |

| Shire PLC | SHP | Health Care | 0.59% |

| British Sky Broadcasting PLC | BSY | Consumer Services | 0.58% |

| Pearson PLC | PSON | Consumer Services | 0.56% |

| Royal Bank Of Scotland PLC | RBS | Financials | 0.56% |

| Morrison (WM) Supermarkets | MRW | Consumer Services | 0.50% |

| Experian PLC | EXPN | Industrials | 0.47% |

| Old Mutual PLC | OML | Financials | 0.45% |

| Reed Elsevier PLC | REL | Consumer Services | 0.45% |

| Cairn Energy PLC | CNE | Oil & Gas | 0.44% |

| Sainsbury (J) PLC | SBRY | Consumer Services | 0.44% |

| Carnival PLC | CCL | Consumer Services | 0.42% |

| Smith & Nephew PLC | SN. | Health Care | 0.42% |

| Randgold Resources | RRS | Basic Materials | 0.41% |

| Marks & Spencer PLC | MKS | Consumer Services | 0.40% |

| Kingfisher PLC | KGF | Consumer Services | 0.39% |

| Capita Group PLC | CPI | Industrials | 0.37% |

| Legal & General Group PLC | LGEN | Financials | 0.36% |

| Autonomy Corp PLC | AU. | Technology | 0.35% |

| International Power PLC | IPR | Utilities | 0.35% |

| Land Securities Group PLC | LAND | Financials | 0.34% |

| Wolseley PLC | WOS | Industrials | 0.33% |

| Smiths Group PLC | SMIN | Industrials | 0.32% |

| MAN Group PLC | EMG | Financials | 0.31% |

| RSA Insurance PLC | RSA | Financials | 0.31% |

| Standard Life PLC | SL. | Financials | 0.31% |

| Eurasian Natural Resources PLC | ENRC | Basic Materials | 0.30% |

| Next PLC | NXT | Consumer Services | 0.30% |

| Aggreko PLC | AGK | Industrials | 0.29% |

| AB Food PLC | ABF | Consumer Goods | 0.29% |

| British Land PLC | BLND | Financials | 0.29% |

| G4S PLC | GFS | Industrials | 0.29% |

| ARM Holdings PLC | ARM | Technology | 0.28% |

| Inmarsat PLC | ISAT | Telecommunications | 0.28% |

| United Utilities PLC | UU. | Utilities | 0.28% |

| Antofagasta PLC | ANTO | Basic Materials | 0.26% |

| Bruberry Group PLC | BRBY | Consumer Goods | 0.25% |

| Intercontinental Hotels PLC | IHG | Consumer Services | 0.25% |

| Petrofac PLC | PFC | Oil & Gas | 0.25% |

| Johnson Matthey PLC | JMAT | Basic Materials | 0.24% |

| Lonmin PLC | LMI | Basic Materials | 0.23% |

| Sage Group PLC | SGE | Technology | 0.23% |

| Serco Group PLC | SRP | Industrials | 0.23% |

| Vedanta PLC | VED | Basic Materials | 0.23% |

| Severn Trent PLC | SVT | Utilities | 0.22% |

| 3i Group PLC | III | Financials | 0.21% |

| AMEC PLC | AMEC | Oil & Gas | 0.21% |

| Rexam PLC | REX | Industrials | 0.21% |

| Admiral Group PLC | ADM | Financials | 0.20% |

| Cobham PLC | COB | Industrials | 0.20% |

| ICAP PLC | IAP | Financials | 0.20% |

| Hammerson PLC | HMSO | Financials | 0.19% |

| Kazakhmys PLC | KAZ | Basic Materials | 0.19% |

| Whitbread PLC | WTB | Consumer Services | 0.19% |

| British Airways PLC | BAY | Consumer Services | 0.18% |

| Bunzl PLC | BNZL | Industrials | 0.18% |

| Cable&Wireless PLC | CW. | Telecommunications | 0.17% |

| Fresnillo PLC | FRES | Basic Materials | 0.17% |

| Intertek Group PLC | ITRK | Industrials | 0.17% |

| Invensys PLC | ISYS | Technology | 0.17% |

| Investec PLC | INVP | Financials | 0.17% |

| Schroders PLC | SDR | Financials | 0.17% |

| Alliance Trust PLC | ATST | Financials | 0.16% |

| Capital Shopping Centers Group PLC | CSCG | Financials | 0.15% |

| Home Retail PLC | HOME | Consumer Services | 0.15% |

| Segro PLC | SGRO | Financials | 0.15% |

| Thomas Cook PLC | TCG | Consumer Services | 0.13% |

| London Stock Exchange Group PLC | LSE | Financials | 0.10% |

| Tui Travel PLC | TT. | Consumer Services | 0.09% |

| Schroders PLC (nv) | SDRC | Financials | 0.05% |

| Rolls-Royce Group - C shares | Not listed | Engineering | 0.01% |

Other FTSE Indices

Even though the FTSE 100 Index is most widely used, FTSE All-Share Index is more comprehensive as it aggregates the FTSE 100, FTSE 250 and FTSE SmallCap indices. Other related indices are the FTSE 250 Index (which lists the next largest 250 companies after the FTSE 100), the FTSE 350 Index (which is the aggregation of the FTSE 100 and 250), FTSE SmallCap Index and FTSE Fledgling Index.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from FTSE Index to Dow Jones Index

Back from FTSE Index to Best Online Trading Site for Beginners home page