Nasdaq 100 Index

All about the Nasdaq 100 index, most often and worldwide used benchmark for stocks in technology sector.

The Nasdaq 100 index is a stock market index, which includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange; the index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology.

Index Calculation

The Nasdaq 100 index is weighted by modified market capitalization of its constituents, with certain rules capping the influence of the largest components. Index also includes companies incorporated outside the US.

Selection Of Index Components

To be eligible for initial inclusion in the Nasdaq 100 index, a security must meet the following criteria: must be listed for at least 2 years exclusively on NASDAQ and average daily volume must be at least 200,000 shares. Issuer may not be in bankruptcy proceedings and only one class of company stocks is allowed to be included in index.

NASDAQ is reviewing the composition of the Nasdaq 100 index on a yearly basis and is adjusting the weightings of index components using a proprietary algorithm, if certain pre-established weight distribution requirements are not met.

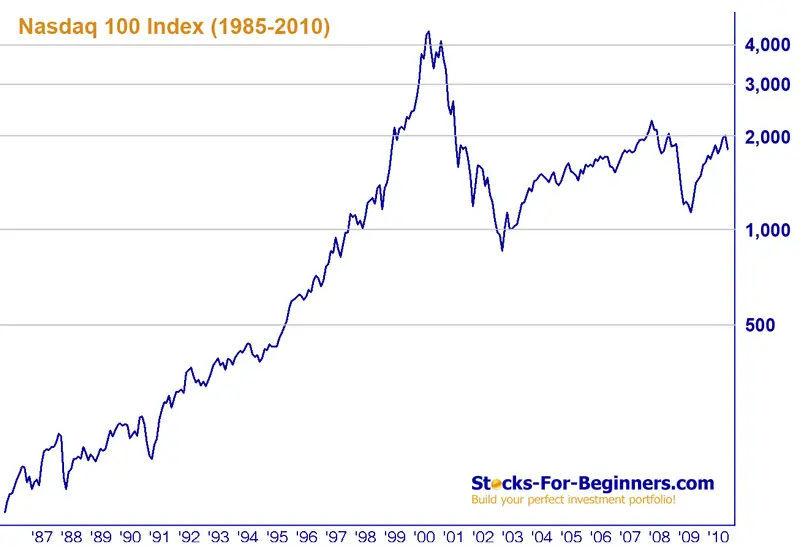

Index Historical Chart

The base price of the index was initially set at 250 on January 31, 1985 and reset at 125 on December 31, 1993. Nasdaq 100 index reached all-time highs in Dot-Com Bubble in 2000, when index stand above the 4,700 level. The latest biggest correction of the index happened in global Financial Crisis of 2008, when index fell below the 2,000 level.

Index Sector Allocation

The Nasdaq 100 index has the following sector allocation (as of 5/20/2010):

- Information Technology: 62.57%

- Health Care: 15.48%

- Consumer Discretionary: 15.00%

- Industrials: 4.23%

- Telecommunication Services: 1.57%

- Consumer Staples: 0.79%

- Materials: 0.36%

Index Components

The Nasdaq 100 index components shown in table below are sorted by weightings and valid as of 05/20/2010.

| Country | Company | Symbol | Sector | Weight |

|---|---|---|---|---|

| US | Apple Inc. | AAPL | Information Technology | 18,14% |

| US | Microsoft Corp. | MSFT | Information Technology | 4,94% |

| US | QUALCOMM Inc. | QCOM | Information Technology | 4,35% |

| US | Google Inc. | GOOG | Information Technology | 4,25% |

| US | Cisco Systems Inc. | CSCO | Information Technology | 2,88% |

| US | Oracle Corp. | ORCL | Information Technology | 2,82% |

| US | Intel Corp. | INTC | Information Technology | 2,43% |

| Israel | Teva Pharmaceutical Industries Ltd. (ADS) | TEVA | Health Care | 2,42% |

| US | Amazon.com Inc. | AMZN | Consumer Discretionary | 2,13% |

| Canada | Research In Motion Ltd. | RIMM | Information Technology | 2,06% |

| US | Gilead Sciences Inc. | GILD | Health Care | 1,98% |

| US | Starbucks Corp. | SBUX | Consumer Discretionary | 1,56% |

| US | Celgene Corp. | CELG | Health Care | 1,53% |

| US | Amgen Inc. | AMGN | Health Care | 1,50% |

| US | DIRECTV | DTV | Consumer Discretionary | 1,47% |

| US | Express Scripts Inc. | ESRX | Health Care | 1,47% |

| US | Comcast Corp. | CMCSA | Consumer Discretionary | 1,46% |

| US | eBay Inc. | EBAY | Information Technology | 1,22% |

| China | Baidu Inc. (ADS) | BIDU | Information Technology | 1,10% |

| US | News Corp. | NWSA | Consumer Discretionary | 1,09% |

| US | Genzyme Corp. | GENZ | Health Care | 0,99% |

| US | Adobe Systems Inc. | ADBE | Information Technology | 0,98% |

| US | Paccar Inc. | PCAR | Industrials | 0,96% |

| US | Bed Bath & Beyond Inc. | BBBY | Consumer Discretionary | 0,92% |

| US | Biogen Idec Inc. | BIIB | Health Care | 0,87% |

| US | Automatic Data Processing Inc. | ADP | Information Technology | 0,87% |

| US | Cognizant Technology Solutions Corp. | CTSH | Information Technology | 0,82% |

| US | Intuit Inc. | INTU | Information Technology | 0,81% |

| US | Costco Wholesale Corp. | COST | Consumer Staples | 0,79% |

| US | Broadcom Corp. | BRCM | Information Technology | 0,77% |

| US | Symantec Corp. | SYMC | Information Technology | 0,75% |

| United Kingdom | Vodafone Group PLC (ADS) | VOD | Telecommunication Services | 0,74% |

| US | Intuitive Surgical Inc. | ISRG | Health Care | 0,73% |

| US | Activision Blizzard Inc. | ATVI | Information Technology | 0,71% |

| US | NetApp Inc. | NTAP | Information Technology | 0,69% |

| US | Sears Holdings Corp. | SHLD | Consumer Discretionary | 0,64% |

| Bermuda | Marvell Technology Group Ltd. | MRVL | Information Technology | 0,64% |

| US | Staples Inc. | SPLS | Consumer Discretionary | 0,63% |

| US | Dell Inc. | DELL | Information Technology | 0,62% |

| US | Yahoo! Inc. | YHOO | Information Technology | 0,61% |

| US | Wynn Resorts Ltd. | WYNN | Consumer Discretionary | 0,60% |

| US | Paychex Inc. | PAYX | Information Technology | 0,60% |

| US | CA Inc. | CA | Information Technology | 0,59% |

| US | Citrix Systems Inc. | CTXS | Information Technology | 0,58% |

| US | Altera Corp. | ALTR | Information Technology | 0,58% |

| US | priceline.com Inc. | PCLN | Consumer Discretionary | 0,57% |

| US | C.H. Robinson Worldwide Inc. | CHRW | Industrials | 0,57% |

| US | SanDisk Corp. | SNDK | Information Technology | 0,56% |

| US | Mattel Inc. | MAT | Consumer Discretionary | 0,54% |

| US | Life Technologies Corp. | LIFE | Health Care | 0,54% |

| US | Fiserv Inc. | FISV | Information Technology | 0,54% |

| US | Apollo Group Inc. | APOL | Consumer Discretionary | 0,53% |

| US | Applied Materials Inc. | AMAT | Information Technology | 0,53% |

| US | Xilinx Inc. | XLNX | Information Technology | 0,53% |

| Luxembourg | Millicom International Cellular S.A. | MICC | Telecommunication Services | 0,51% |

| US | First Solar Inc. | FSLR | Industrials | 0,49% |

| US | Linear Technology Corp. | LLTC | Information Technology | 0,49% |

| US | Expeditors International of Washington Inc. | EXPD | Industrials | 0,48% |

| Cayman Islands | Seagate Technology Inc. | STX | Information Technology | 0,48% |

| US | BMC Software Inc. | BMC | Information Technology | 0,46% |

| US | Vertex Pharmaceuticals Inc. | VRTX | Health Care | 0,45% |

| US | Fastenal Co. | FAST | Industrials | 0,42% |

| US | Liberty Media Holding Corp. Interactive (Series A) | LINTA | Consumer Discretionary | 0,41% |

| US | NVIDIA Corp. | NVDA | Information Technology | 0,41% |

| US | Autodesk Inc. | ADSK | Information Technology | 0,41% |

| US | O'Reilly Automotive Inc. | ORLY | Consumer Discretionary | 0,40% |

| US | Cerner Corp. | CERN | Health Care | 0,40% |

| US | Ross Stores Inc. | ROST | Consumer Discretionary | 0,39% |

| Israel | Check Point Software Technologies Ltd. | CHKP | Information Technology | 0,39% |

| US | KLA-Tencor Corp. | KLAC | Information Technology | 0,38% |

| Cayman Islands | Garmin Ltd. | GRMN | Consumer Discretionary | 0,37% |

| US | Expedia Inc. | EXPE | Consumer Discretionary | 0,37% |

| India | Infosys Technologies Ltd. (ADS) | INFY | Information Technology | 0,37% |

| US | Mylan Inc. | MYL | Health Care | 0,36% |

| US | Sigma-Aldrich Corp. | SIAL | Materials | 0,36% |

| US | Urban Outfitters Inc. | URBN | Consumer Discretionary | 0,35% |

| Ireland | Warner Chilcott Plc | WCRX | Health Care | 0,35% |

| Singapore | Flextronics International Ltd. | FLEX | Information Technology | 0,34% |

| US | Electronic Arts Inc. | ERTS | Information Technology | 0,33% |

| US | NII Holdings Inc. | NIHD | Telecommunication Services | 0,33% |

| US | Maxim Integrated Products Inc. | MXIM | Information Technology | 0,32% |

| US | Stericycle Inc. | SRCL | Industrials | 0,31% |

| US | Virgin Media Inc. | VMED | Consumer Discretionary | 0,30% |

| US | Henry Schein Inc. | HSIC | Health Care | 0,30% |

| US | Lam Research Corp. | LRCX | Information Technology | 0,30% |

| US | Qiagen N.V. | QGEN | Health Care | 0,29% |

| US | VeriSign Inc. | VRSN | Information Technology | 0,29% |

| US | Illumina Inc. | ILMN | Health Care | 0,28% |

| US | Dentsply International Inc. | XRAY | Health Care | 0,28% |

| US | Cintas Corp. | CTAS | Industrials | 0,28% |

| US | Joy Global Inc. | JOYG | Industrials | 0,28% |

| US | DISH Network Corp. | DISH | Consumer Discretionary | 0,27% |

| US | Flir Systems Inc. | FLIR | Information Technology | 0,27% |

| US | Cephalon Inc. | CEPH | Health Care | 0,26% |

| US | J.B. Hunt Transport Services Inc. | JBHT | Industrials | 0,25% |

| US | Microchip Technology Inc. | MCHP | Information Technology | 0,25% |

| US | Hologic Inc. | HOLX | Health Care | 0,24% |

| US | Patterson Cos. Inc. | PDCO | Health Care | 0,21% |

| Switzerland | Foster Wheeler AG | FWLT | Industrials | 0,19% |

| Switzerland | Logitech International S.A. | LOGI | Information Technology | 0,14% |

Differences from NASDAQ Composite index

The Nasdaq 100 index is frequently confused with the Nasdaq Composite Index, which is often referred to simply as "The Nasdaq"; it includes stocks of every company that is listed on NASDAQ stock market, all together more than 3,000.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Nasdaq 100 Index to Dow Jones Index

Back from Nasdaq 100 Index to Best Online Trading Site for Beginners home page