Nasdaq Composite Index (COMP)

Nasdaq Composite Index is a stock market index out of more than 2,500 U.S. and non-U.S. technology and growth companies listed on the NASDAQ stock market.

The Nasdaq Composite Index is a stock market index of the common stocks and similar securities (e.g. ADRs, tracking stocks, limited partnership interests) listed on the NASDAQ stock market, meaning that it has over 2,500 components. It is highly followed in the U.S. as an indicator of the performance of stocks of technology companies and growth companies. Since both U.S. and non-U.S. companies are listed on the NASDAQ stock market, the index is not exclusively a U.S. index.

Calculation Of Index

The NASDAQ Composite Index is a market capitalization-weighted index. The value of the Index equals the aggregate value of the Index share weights, also known as the Index Shares, of each of the Index Securities multiplied by each such security's Last Sale and divided by the divisor of the Index.

Two versions of the Index are calculated - a price return index and a total return index. The price return index (NASDAQ: COMP) is ordinarily calculated without regard to cash dividends on Index Securities. The total return index (NASDAQ: XCMP) reinvests cash dividends on the ex-date. Both Indexes ordinarily reinvest extraordinary cash distributions. The total return index was synchronized to the value of the price return index at the close on September 24, 2003.

The Index is calculated during the trading day and is disseminated once per second from 09:30:01 to 17:16:00 ET. The closing value of the Nasdaq Composite Index may change up until 17:15:00 ET due to corrections to the Last Sale Price of the Index Securities.

Selection Of Index Components

To be eligible for inclusion in the Nasdaq Composite Index, a security's U.S. listing must be exclusively on the NASDAQ Stock Market (unless the security was dually listed on another U.S. market prior to 2004 and has continuously maintained such listing), and have a security type of either:

- American Depositary Receipts (ADRs)

- Common Stock

- Limited Partnership Interests

- Ordinary Shares

- Real Estate Investment Trusts (REITs)

- Shares of Beneficial Interest (SBIs)

- Tracking Stocks

Closed-end funds, convertible debentures, exchange traded funds, preferred stocks, rights, warrants, units and other derivative securities are not included. Unlike other market indexes, the Nasdaq composite is not limited to companies that have U.S. headquarters. If at any time during the year an Index Security no longer meets the Eligibility Criteria, or is otherwise determined to have become ineligible for continued inclusion in the Nasdaq Composite Index, the security is removed from the Index.

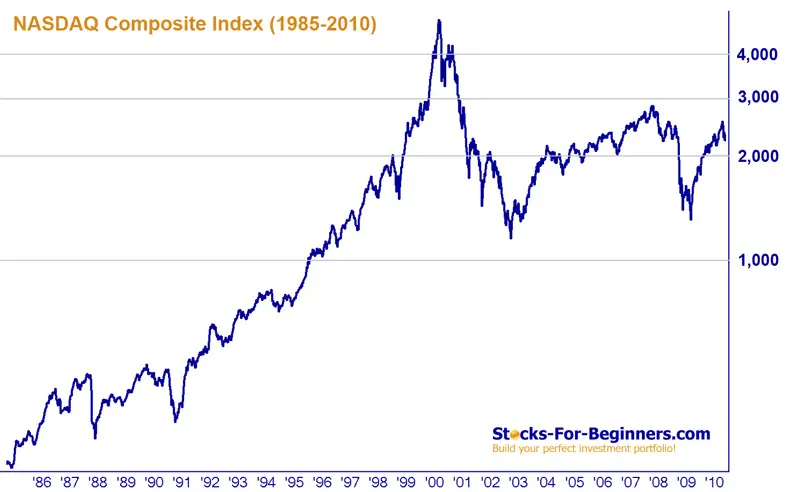

Index Historical Chart

Nasdaq Composite began on February 5, 1971 at a Base Value of 100.00; the highest value 5,132.52 was reached in March 2000. The latest minimal value of the index was reached in March 2009, when index reached the 1,265.52 level.

Index Sector Allocation

Nasdaq Composite has the following sector allocation (as of 4/30/2010):

- Information Technology 51.87%

- Consumer Discretionary 14.45%

- Health Care 14.34%

- Financials 7.72%

- Industrials 5.58%

- Consumer Staples 1.86%

- Telecommunication Services 1.62%

- Energy 1.34%

- Materials 1.12%

- Utilities 0.08%

Index Components

Top 10 Nasdaq Composite components represent 34.24% of the overall portfolio; they are sorted by weightings in table below and valid as of 4/30/2010.

- MICROSOFT CORP

- APPLE INC

- CISCO SYSTEMS INC

- GOOGLE INC

- ORACLE CORP

- INTEL CORP

- QUALCOMM INC

- AMAZON.COM INC

- AMGEN INC

- TEVA PHARMACEUTICAL IND ADR

U.S. stocks represent 92.55% share and foreign stocks represent 7.45% share. In terms of currency diversification US dollar has a 98.4% share and Canadian dollar has 1.6% share.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Nasdaq Composite Index to Dow Jones Index

Back from Nasdaq Composite Index to Best Online Trading Site for Beginners home page

Building an investment portfolio from scratch or optimizing existing one can be quite a challenging job.

Our 'PORTFOLIO BUILDER' is a type of money management software that was designed to help you optimize you investment portfolio, according to your unique saving goals, yields expectations, risk tolerance and time horizon.

Important! We only accept limited FREE trials per month. You had better run the portfolio optimizer now. It can save you a lot of money.