Support and Resistance Trading Importance

Support and resistance trading is important concept of technical analysis, describing the battle between bulls and bears at price levels that are difficult to cross.

Support and resistance trading is the next major concept of technical analysis after good understanding of a stock market trend. Technicians often talk about the ongoing battle between the buyers (bulls, demand) and sellers (bears, supply), which is revealed by the seldom moves of the stock price above the resistance or below the support levels.

Support and resistance trading levels are price levels on the chart that are difficult to cross - breakouts are seldom. Support is representing the price level through which stock rarely falls, while resistance is the price level that stock rarely surpasses.

Role of Market Psychology in Support and Resistance Trading

The reason why support and resistance trading levels are formed on the chart and why they are so powerful and though to cross lies in the market psychology.

Support and resistance levels are formed by supply and demand; there is a high demand at support levels, meaning many buyers are willing to buy at that price, while on the other side, the supply is very high at resistance levels, meaning many sellers are willing to sell at that price. When support and resistance trading levels are broken, the market psychology behind the movement shifts and new support/ resistance levels will be established.

Support and Resistance Levels Are Formed by Investors Psychology

Forming of support and resistance levels can be very well understood by next often seen trading example.

Majority of investors buy a stock in the latest stage of its short or medium term trend growth. Professionals and experienced traders and investors spot the trend reversal in early stages of its development, while the "mass" it the last entering the position. What happens often is that the trend changes its direction and you find yourself in the losing position soon. That has a very negative impact on your confidence - you are not so sure anymore that you made the right trade and when the situation gets worse, you start doubting about your ability to find top stock picks on your own.

When the stock price falls far below your entrance point you promise yourself to exit the position as soon as you get equal. Because the prices are so low, they attract professionals again and they start buying and manage to change the trend upwards again. Since you were not the only one with the same sad trading story - the whole mass is thinking exactly the same as you are - the selling pressure is established in the area where majority of traders/ investors entered the position and resistance level is formed. And it goes on and on, the market or stock price moves between support and resistance trading levels (professionals buying at support levels and scares mass selling at resistance levels) until an important fundamental change in the company business initiates the break through one of them.

Importance of Round Numbers in Market Psychology

Round numbers, like 10, 20. 35, 50, 100 and 1,000 have an important role in forming support and resistance trading levels, because they represent the major psychological turning points at which many investors and traders make buying or selling decisions. Round numbers attract investors, buying and selling pressure increases at this prices making them important support and resistance trading levels.

Breakout and the Role Reversal Scenario

There will come the time, when support or resistance level will be broken. In case that support level is broken downwards, the same price level becomes new resistance level from that moment on. If the resistance level is broker upward it becomes the new support level. The shift in supply and demand causes the breached level to reverse its role, however, for a true reversal to occur it is important that breakout is characterized as strong move, which is normally supported by higher volume.

Support and Resistance Trading Strategy

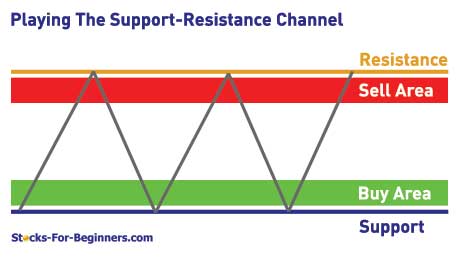

Playing the Support-Resistance Channel

Support and resistance trading analysis can be used to make investment decisions and help you identifying trend reversals. The more times that support or resistance levels are tested and not broken, the more powerful they are and the trend is likely to continue. Therefore you can build your strategy to buy close to support levels and sell close to resistance levels. A more risky approach could work in opposite direction also, to sell short in the area of resistance and closing the position in the area of support.

When you will be placing orders, there is one simple rule to be followed. You should place the limit buy order a few points above the support level if you are bullish on a stock and not directly on the support level, because the price never actually reaches the exact number. If you are bearish on the stock, you should place a stop sell order just below and not directly on the resistance level.

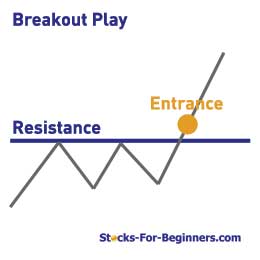

Playing the Breakout's

Another trading strategy is focused on breakouts and two different approaches are most common. The first one is to play the breakout as it happens. This strategy can bring you higher returns in case that breakout was successful, but this method carries also a lot of risk, since there are many false breakouts. You should pay close attention to volume; well above average volume is suggesting that breakout success is more likely, while low volume breakouts are more dangerous.

A far less risk approach is to wait after breakout for the price to return to the breakout level for confirmation of role reversal. If the new support level (before it was resistance level) can successfully withstand the first selling pressure, the probability of true breakout gets much higher. However, you should always wait for the green candle to enter the long position! Disadvantage of this approach is that you can miss some breakouts that are so strong, that price doesn't come close to the breakout level any more.

Risk Management

In each of the strategies you should take care of risk management. The most common method is to setup a stop-loss order just below the support level in case of going long, or just above the resistance level in case of shorting a stock.

Recommended Reading - Recommended Reading - Recommended Reading - Recommended Reading

Back To Technical Stock Analysis Index...

Next step: Stock market technical analysis and abnormal trading volume...

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Support and Resistance Trading to Investing in Stock Market

Back from Support and Resistance Trading to Best Online Trading Site for Beginners home page