Stock Valuation Methods - Introduction

Discounted cash flow and ratio analysis are the most common used stock valuation methods used by Wall Street analysts. Let us have a look how they work.

Investors use different stock valuation methods when determining stock fair value, also called stock intrinsic value. The most common methods base on concepts behind discounted cash flow or ratio valuations.

Stock Valuation Methods Based on Discounted Cash Flow (DCF)

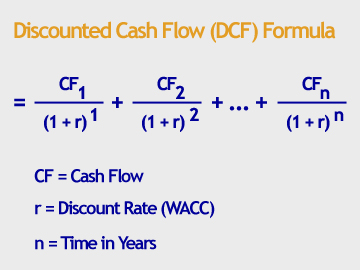

The discounted cash flow (DCF) method is quite simple to understand, but implementing it can be a difficult task. Let us first explain the pure concept of this method. The basic idea of DCF is that the company's current value should be equal to the present value of its future cash flows.

Does it sound complicated? Let us put it in another way; DCF method tries to figure out how much a company is worth today, based on projections of how much cash it can generate in the future. If the company generates $1 cash per share every year and it will continue to do so in the future, you can calculate how much the future cash flow worth today is.

You should be familiar with present and future value of money to understand the logic behind this stock valuation method. What would you rather choose: $100 today or $100 after five years? I guess you would rather pick the first option, because you know, that if you receive $100 today, you can invest this money and have more than $100 after five years time. If you turn around your thinking about time value of the money, you will agree that $1 that the company will generate for shareholders after 10 years is worth less than $1 this year. That is why DCF method discounts future cash flows.

After the stock intrinsic value is calculated, you should compare the final figure of stock fair price with the current stock market price to see, weather the stock is undervalued or overvalued.

There are varieties of discounted cash flow stock valuation methods, depending on the type of cash flow used in the calculation. For example, the dividend discount model (DDM) focuses on dividends the company pays out to its shareholders every year, while free cash flow to equity, which is commonly used on Wall Street) model focuses on the cash flow after all expenses, reinvestments and debt repayments. Both stock valuation methods use the same logic behind it - present value of future cash flows.

The biggest problem of discounted cash stock valuation methods is in many estimates and assumptions required before calculating stock intrinsic value. First, you have to forecast future revenues and expenses of the company for the next 10 or more years, which can be a very difficult task. Determining the right discount rate (WACC) is another key factor to your result - a small change in discount rate has a big impact on the final result an your investment decision.

Ratio Valuation

Another approach to stock valuation is by calculating different financial ratios out of financial statements. Some of the most well-know ratios are P/E - price to earnings ratio, P/B - price to book ratio, P/S - price to sales ratio, ROE - return on equity ratio, PEG - price earnings to growth ration and so on.

To calculate the company's real value, you can compare calculated valuation ratios on absolute basis to its threshold values, to its historical values and mainly to its competitors and overall market itself. For example, a P/E ratio of 5 sounds very low compared to historical market average of 15, but that does not yet mean that this stock is a good buy. You should compare it with its competitors and current market valuations to get more in-depth information.

Recommended Reading - Recommended Reading - Recommended Reading - Recommended Reading

Back To Fundamental Stock Analysis Index...

Next step: Discounted cash flow valuation...

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Stocks Valuation Methods to Investing in Stock Market

Back from Stock Valuation Methods to Best Online Trading Site for Beginners home page