Discounted Cash Flow Valuation Model In 5 Easy Steps - Simple Spreadsheet Calculation Method

Discounted cash flow valuation (DCF) is a useful method of calculating stocks' fair value - powerful indicator for smart long-term investment decisions.

Stock analysts use discounted cash flow valuation to get the fair value of the company based on the projections of how much money will the company generate to investors in the future. There are several factors to consider, when performing DCF valuation.

Forecasting the Period and Revenue Growth of the Company

- Step 1 of Discounted cash flow valuation

First thing to determine is how far in the future you will project and discount cash flows. The forecasting period depends on the company's competitive position and how long will the company be able to generate excess returns to investors. Every company settles into maturity phase eventually.

As a rule of thumb, the forecasting period should be 5 years for solid companies with strong marketing channels, recognizable brand or any other advantage. For slow growing companies operating in high competitive industry with low margins, the forecasting period should be shorter (1 year or so). For outstanding growth companies, dominating in their industry, with high barriers to enter, the forecast period can be up to 10 years.

After you will define the forecasting period, proceed to forecasting the revenue growth over this period. Although the future is uncertain, try to estimate how the market will look like in a few years time, will it expand or contract, forecast the market share of the company, do you expect any new products driving sales, will the pricing change, and so on. The basis for estimated future revenue growth lays in the last two years average growth rate and management forecasts. It is wise to prepare three possible outcomes: optimistic, pessimistic and realistic one.

Forecasting Free Cash Flows

- Step 2 of Discounted cash flow valuation

Free cash flow is the cash left to the company after all the operating cash expenses are paid. Free cash flow enhances value to shareholders and can be used for R&D, paying out dividend or for buying back shares. We have examined the calculation of free cash flow in cash flow statement analysis.

You should first forecast the future operating costs. The easiest way to do that is to look at historic operating costs margin, expressed as proportion of revenues. Then adopt the future operating cost margin if needed.

Taxation is another figure to forecast. Be aware that companies with high capital expenditures do not have to pay taxes in year of investments. Therefore, it makes sense to calculate average taxation rate for the past few years and apply it to the future (average annual income tax paid divided by profits before income tax).

The next figure to forecast is net investment or capital invested in property, plants and equipment to sustain future growth. Calculate net investment as capital expenditures (from cash flow statement) minus non-cash depreciation (from income statement). Compare this figure with income to get investment ratio and then apply this figure to the future. Check competitors; if they are investing more aggressively, you can expect the company will have to invest at higher rate also.

The last figure in calculating future free cash flows is change in working capital. It represents the cash needed for day-to-day operations, to maintain current assets, such as inventory. Calculate working capital as current assets minus current liabilities; you can find both figures in balance sheet. Afterwards calculate the net change in working capital by comparing figures between two consecutive years. Take into consideration that normally increase in sales requires higher working capital to finance bigger investment in inventory and receivables.

At the end, calculate Free Cash Flow for every year of forecasted period by the following formula:

Free Cash Flow (FCF) =

Sales Revenue - Operating Costs - Taxes - Net Investment - Change in Working Capital

Importance of Discount Rate in FCF Calculation

- Step 3 of Discounted cash flow valuation

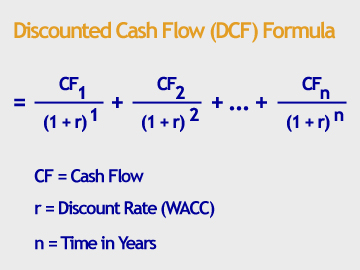

At this stage, we know the predicted future free cash flows of the company for every year of the forecasting period. Now we have to calculate the net present value of these future free cash flows and to do that, we need to determine the discount rate. This is one of the crucial factors in discounted cash flow valuation, because a very small difference in discount rate has a big impact on the company's fair value. Different methods of determining discount rate exist, but the weighted average cost of capital (WACC) is most commonly used.

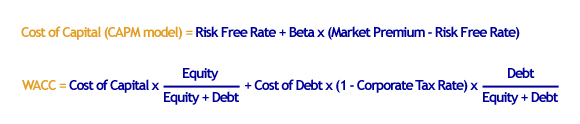

WACC is a function of debt to equity and cost of both of them. While the cost of debt is very straight forward (the current market rate at which the company is paying back its debt), there are more open questions regarding the cost of equity. The most common way of calculating cost of equity is to sum risk free rate and premium for equity markets. The latest number is additionally multiplied by beta, which is representing the above or below average risk for the industry, a company operates in. This method of calculating cost of capital is called CAPM model (capital asset pricing model) and has won a Nobel prize. Here are all the formulas needed for calculation.

The WACC calculation looks simple, but in practice, it rarely happens that two analytics derive the same WACC, because of all the variables in the formula.

Calculating Company's Terminal Value

- Step 4 of Discounted cash flow valuation

After we calculate free cash flow over the forecasted years, we have to figure out the total value of free cash flows afterwards. If we do not perform this step, your assumption is that the company will stop operating after the forecasted period, which is probably not the case.

As you have already seen, it is difficult to forecast cash flows for next few years. You can imagine that forecasting cash flows for the entire future of the company lifetime is even tougher task.

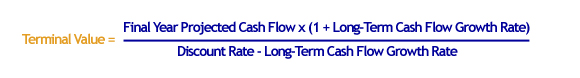

One possible way of calculating the terminal value is by using Gordon Growth Model, which simplifies the task by assuming that company's cash flow will stabilize after last projected year and will continue at the same rate forever. Here is the formula:

Another possibility of determining terminal value of the company is to use multipliers of income or cash flow measures (net income, net operating profit, EBITDA, operating cash flow or FCF), which are determine by comparable companies on the market.

Terminal value plays a big role in final figure of company's value. Therefore, we recommend you to be rather more conservative with estimates.

Calculating the Fair Value of the Company and Its Equity

- Step 5 of Discounted cash flow valuation

Now we can finally calculate the fair enterprise value (EV). Discount every year's cash flow with the appropriate discount factor.

The last step of calculating the fair value of the stock is to deduct net debt out of the enterprise value. You should further divide the fair equity value of the company by number of outstanding shares and here you go, the fair price of one share is here.

Investment logic from here on is quite simple. If the stock is trading below its fair value, you should consider buying it and vice versa. If the stock is trading above its fair value, you should consider selling it.

Advantages and Disadvantages of DCF Valuation Model

Advantages

- Useful method when use of multiples to compare stocks makes no sense (if the whole sector or industry is under- or overvalued for example).

- The method is based on free cash flow (FCF), which is a trustworthy measure compared to some other figures and ratios calculated out of income statement or balance sheet.

Disadvantages

- The FCF method is only as good as its assumptions are. The result can fluctuate widely with just a small change in your estimations about free cash flows, discount rate or growth rates. Use conservative scenario next to realistic one.

- The method is not so useful when analysts have problems with visibility of the company's trends (sales, costs, prices, etc.).

- Finally, be aware that DCF model is not suitable for short-term trading; it is only useful for long-term investments.

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

Where to Invest Money Safely Now, Today, 2011 To Get Good Returns?

Would you like to know where to invest money? Find fresh stock research, analysis and strategies, plus latest news, discussions and experts' opinions.

Online Stock Brokers - Reviews, Ratings, Comparison, and More

Selecting online stock broker is an important initial step of every trader or investor. Take smart decision with reviews, tools and articles published here.

Written by: Goran Dolenc

Back from Discounted Cash Flow Valuation to Investing In Stock Market

Back from Discounted Cash Flow Valuation to Best Online Trading Site for Beginners Home Page