Money Saving Expert about Importance of Saving

You do not have to be money saving expert to become financially independent. With saving and consistency you can reach any financial goal.

Generally there are two goals for saving money: security and safety on one hand and planning for better future on the other hand. Do you know your financial goals? What are you looking for in terms of your personal financial status? One of the saddest facts is that majority of people start realizing importance of saving money when it is too late.

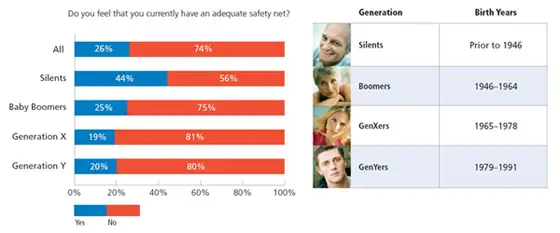

How Many People Have Adequate Emergency Fund?

Nearly three-quarters (74%) of the public do not!

Saving for the Worst

In terms of security and safety, there is possibility that you lose your job, become disabled or any other disastrous financial crisis influences your life. It is small probability it will happen to you, but the fact is, it can happen and if it does, you must be prepared for it. You have to have a plan for such situations. A professional money saving expert would advise you to get insurance for such extreme situations. It is always good to have some additional money aside, no matter what.

You normally can get insurance for almost anything today. But with insurance you can always choose to be insured for higher or lower amount. Many people are for example over-insured, because insurance agents do their job very well. But why would you get all-in insurance, for example all-in car insurance, if you only drive a car twice a year? It makes no sense; there is very little chance that you will have a car accident. Always think from your personal point of view! Insurance companies are making large profits and guess what, these profits come from your insurance policies. Again, think about probability, otherwise you will overpay the service provided!

Money saving expert tip of the day: By the rule of the thumb, you should build a permanent savings cushion of 3 to 6 months worth of living expenses!

Investing for Better Future

Better future includes investing for retirement, your children's education and scholarships, sport activities, traveling around the world, buying your first or better car, etc. With these investments you can generally afford higher risk. Please understand, the longer the time frame of your investment, the more risk you can afford.

If you would really like to live without a daily stress about your personal money standings and reach financial freedom one day, you will have to plan your savings. This process is well known as money management and it defines how much money you should invest in different asset classes like bank savings, investments in stocks and funds or even more risky markets. We recommend you to read the beginners guide to investing.

Any money saving expert will warn you, that there is no real easy money out there! If someone is promising you a way to get rich quick out of nothing, and I know there are many such services out there, you have to be aware, that it probably has to do with some kind of financial fraud. Building financial wealth is a step by step long-term process. Of course, you can be lucky and win a lottery ticket.

Yap, everything starts with saving money. This concept is as old as money itself but an extremely tough one to master considering all the debt that people have succumbed to. Saving that extra dollar, especially when the economy takes a downturn is highly critical but also the most challenging one. I know you probably live paycheck to paycheck from month to month. Well, join the club! But no matter how small of an amount you can afford to set aside every month, it's indeed important to save money and you should start 'yesterday'.

Crisis Remind People of the Importance for Saving Money

Awareness of importance for saving money is obviously cyclical. It normally increases through financial crises, like the last one which started in 2008 and has not yet ended. Before the crisis, very few people had a savings account. People were relying on credit cards to meet emergencies and to fund luxury purchases. However, things are changing now. For one thing, credit is getting tighter and it's no longer wise to count on your credit card limits. Now it is time to pay those credit cards down and set aside as much as you can afford in savings.

And what is the best way to save money? There are different ways and most of the popular guides include the following suggestions: cut the cost of your living wherever possible, search top online shops for best bargains, instantly search the best shopping comparison sites, look for cheap gas & electricity providers, do not overpay on home insurance policy, compare care insurance offers, use top budget airline deals when traveling around, search for discount vouchers and codes and find mega discounts when buying offline, compare top cards for spending, always use the cheapest way to call, compare banks saving accounts, look for 2 for 1 deals for eat-in, collect miles for free flights, use 0% balance transfer along with 0% credit cards, and many more. You can read about this topic in a separate article 10 ways to save money.

Conclusion

Now that you understand why it's important to save money, make your savings goals realistic and start saving step by step. Whatever method you will use to save additional dollars every week, the secret is in consistency. Once you commit to a weekly savings amount, stick to it! There will come the day you'll be glad you started saving and you do not need to be money saving expert to succeed.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Money Saving Expert to How to Invest In Stock

Back from Money Saving Expert to Best Online Trading Site for Beginners home page