10 Ways to Save Money Consistently

Read our list of '10 ways to save money' and learn the most common mistakes you must avoid while doing it in order to succeed.

A lot is written on the web about ways to save money. Every time I read all these money saving tips, I ask myself: Why do so many people have problems with saving money, if everybody knows the ways how to do it? Why do they fail?

Why do People Fail While Saving Money?

Most of the people think they fail in money saving because of their low incomes. But to be honest, only the minority really has this problem, for all other these is just another excuse. Different researches have been made why people fail saving money and there is one interesting conclusion from majority of them: Saving has little to do with your income! I strongly agree with this conclusion. Just look around, the people you know, who has more difficulties saving money, the richest or the poorest? Saving success has more to do with whether you want to save and you are willing to adjust to boost your saving. Keep reading our 10 ways to save money...

Lack of Saving Goals

The problem for failing with saving money is lying somewhere else. I could identify three major reasons, why is money saving a hard job for many of us, even if we know the 10 ways to save money written in this article. The first problem is lack of clear goals why or what are you saving for! Could be new flat, car, bicycle, ring, dress, travel or whatever other reason. If you don't have a clear focus why are you saving, knowing all the ways how to save money will not help you much.

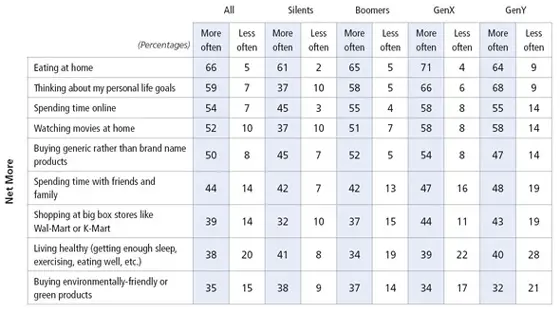

What Kind of Adjustments is Public Making Through the Crisis?

They are picking different ways to save money!

This motivational factor is highly important to succeed, especially if you have long term saving goals. This also answers the question, why so few families take care of their emergency fund. Because this is saving for rainy days, you don't know in front for what exactly you will need this money once; there is no clear saving goal. Our list of 10 ways to save money is waiting for you at the end of this article.

Compound vs. Simple Interests

The second reason for failing while saving money is lack of knowledge in basic math. While financial industry takes advantage of their knowledge in money and finance for the marketing purposes, majority of people cannot differentiate simple interest formula and compound interest formula. But there is enormous difference, especially on the long term and if you are not aware of it, you are not working with correct numbers and again, it de-motivates you in saving more money. You don't know what I am talking about. Let's look at an example.

If you would have $1,000 and would go to a bank and make a 20 year deposit with fixed 10% yearly interest rate, what output can you expect after 20 years? Majority start calculating with simple interest formula. 10% per year on $1,000 is $100, and times 20 (20 years) gives us $2,000 of interest. But this simple math is not right, since it does not include reinvestment of already saved interests paid to our saving account every year.

To get the right result you must use compound interest formula. To simplify, after one year, $100 of interests are paid out to your saving account which means that you start the second year with $1,100 and not only initial $1,000. After second year your interest will therefore be $110 instead of $100. In the first years this difference is not so obvious, but after 20 years, your actual interest will be $5,728 instead of $2,000. Do you see the point? How does this influence on your motivation for saving? You must see the difference between compound and simple interests to get the most out of our 10 ways to save money. You can read more about compound interest and try our simple calculator to learn more about how to invest money.

Consistency

And the third, maybe even the most important reason for failing while saving money is consistency. If your saving plan consists of regular monthly payments to saving account, you have to be very strict in following this plan. People get just too many excuses why they will not pay this month, another month and so on. For example, summer holidays are here and we have to pay larger amount for family travel package to the tropical islands, but these is not reason not to pay $30 into our saving account according to our saving plan. The problem is that almost every month we have some extra costs, just think of winter skiing, extra costs when new school year starts, summer sales, Thanksgiving, Christmas, birthdays, anniversaries and so on. This list of potential excuses on our saving path can be really long and that is why it is very important, that we consistently follow our saving plan. Be strict, do it regularly, no matter what!

10 Ways to Save Money

Now that you know what is important to succeed with saving, let me get back to different ways to save money. I picked up 10 ways to save money, those that really work and bring results immediately.

- Avoid impulse buying. Many of the things you want to buy do not seem all that necessary, if you only you wait for a day or two. Make a list before going grocery shopping. Without a list you will buy items that you simply do not need.

- Cut the cost of your fuel bills. Ride your bike and use public transportation, this saves on gas, insurance and maintenance costs. And when buying a new car, see if you can make it with a pre-owned vehicle. A new car depreciates significantly the moment you drive it out the dealership.

- Bottle your own water. Buy bottled water only once in a while, and then reuse that bottle to fill your own water. In many countries water is already more expensive the gas.

- Don't buy designer labels. Dress and look sharp with less cash, focus on taking a clean, elegant style. Can you honestly say you can tell the difference at a distance between a $600 designer bag and a $9.99 one from the market? Think about it.

- Become a homebody. Consider the library for books, music and movies. Eat out less often and cook at home.

- Trim your cell phone costs. Think of pay-as-you-go phone but be careful. If you actually do talk a lot, you can end up spending a lot more on a prepaid service.

- Regulate your electric use. When not in use, unplug electric appliances.

- Plan vacations ahead of time. You can cut the cost of a vacation significantly by planning and booking ahead of time.

- Reduce your bills by simply asking. One of the most effective means of shaving money. You'd be surprised how easy it is to get discounts on a wide variety of services just by asking.

- Clear your credit card debt. If you're the average American with at least one credit card, you probably have close to $8,000 in credit card debt. At an average APR of 14%, it could cost you more than $1,000 a year in interest alone.

I just pointed out 10 ways to save money. But you are welcome to share your money saving ideas with us.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from 10 Ways to Save Money to How to Invest in Stock

Back from 10 Ways to Save Money to Best Online Trading Site for Beginners home page