Investing in Silver - Why Should You Invest in Silver?

There are number of reasons why you should be investing in silver; could be a hedge against inflation or US dollar, investment or portfolio diversification.

There are number of reasons why you should be investing in silver. Before looking at the reasons, you have to understand where the demand comes from or in other words, many different uses of silver. Curious about real-time silver price? You can find it inside Silver Investing article.

The Many Uses of Silver

For thousands of years, silver has been regarded as a form of money and store of value. Today, silver has also many other uses, which come from a variety of unique properties including strength, malleability, ductility and thermal ability. Silver's unique properties restrict its substitution in most applications.

Investment Vehicles

Use of silver as money has taken place as currency and coinage for thousands of years. Silver coins and silver bars are used as silver investment vehicles for investors desiring to protect their wealth and achieve financial growth. Investors can own bullion by purchasing silver bars in a variety of weights and sizes, from a 1,000-troyounce silver bar to a 1-kilo bar or even a 5-gram bar. Major bullion companies, brokers, and coin dealers sell these bars.

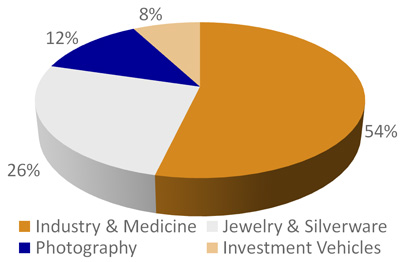

World Silver Fabrication Demand, 2008

Primary use of silver is for industry...

Source: GFMS World Silver Survey 2009

Investing in silver is also possible through silver accounts, mostly offered by Swiss banks, where silver can be instantly bought or sold just like any foreign currency. Unlike physical silver, the customer does not own the actual metal but rather has a claim against the bank for a certain quantity of metal.

There are also other possibilities of investing in silver. You can buy silver mining stocks (for investors who are familiar with the equity market, buying stocks in silver mining firms offers capital appreciation, as well as the potential to earn a dividend), mutual funds (precious metals mutual funds enable investors to buy the general market risk, instead of company-specific risk), Exchange-Traded Funds ETFs (for investors who seek exposure to the physical silver market, but have no desire to possess the metal or pay direct insurance, assay, and storage costs, ETFs offer an alternative), silver futures and options (for sophisticated investors, silver futures allow individuals to control a significant amount of silver for a small fraction of its total value; while silver options provide investors with the right to buy or sell silver at a fixed price, at a specified future date) or CFDs and spread betting.

Industry & Medicine

Silver has the highest electrical conductivity of any element. Due to this fact, it is often used in electronic products such as batteries and catalysts. It can also be used for soldering in electronic circuits and can be found in the contact points of computer keyboards. Due to the superior signal quality of silver it can also be found in high end HI-FI equipment.

Further use for silver include dental and medicinal. It has been discovered that silver has a significant impact on the treatment of burns. Today sulfadiazine is used by hospitals worldwide to kill bacteria, which allows the body time to restore the area naturally. Silver has also been successfully used to grow new skin on accident victims, including the restoration of fingertips. There are other uses for silver which include helping people with allergies, eliminating harmful bacteria and in the use of sunglasses by protecting the eyes from sunlight.

Jewelry & Silverware

Another obvious use of silver is in the jewelry, which is traditionally made from sterling silver, which is 92.5% silver and 7.5% copper. Pure silver is too soft to be used so silversmiths will alloy silver with other metals to harden it.

Due to the reflective nature and tarnish resistance of silver, it is also used in silverware such as cutlery and picture frames.

Photography

Despite the growing popularity of digital photography, silver-based films and papers are still in demand. For instance, medical imaging devices employ silver halide because it produces clear X-rays. Motion picture studios also prefer silver-based film to video for its vibrant color and clarity.

Why Would You Invest in Silver?

By adding precious metals in general, and silver in particular, to a portfolio of stocks, bonds and mutual funds, an investor is increasing the degree of diversification and protects the portfolio against fluctuations in value of any one asset type.

Hedge Against Inflation

Economies fluctuate between inflation, recession and expansion, precious metals investment helps diversify and lower overall risk.

Hedge Against a Declining Dollar

Silver is bought and sold in U.S. dollars, so any decline in the value of the dollar causes the price of silver to rise.

Commodity Investment

Silver, more than other precious metals, has significant demand rooted in sectors as diverse as imaging, electronics, jewelry, coinage, superconductivity and water purification. For this reason, silver is no longer known as just a precious metal, a store of value, a work of art or an industrial metal. It is all of these.

Portfolio Diversifier

The economic forces that affect the price of precious metals are different from, and often are opposed to the forces which determine the price of most common financial assets. This independent movement of precious metals to other financial assets can reduce overall portfolio volatility and contributes balance.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Investing in Silver to Commodities Market

Back from Investing in Silver to Best Online Trading Site for Beginners home page