Inverse ETFs - Be Aware of the Risks!

Inverse ETFs as well as leveraged ETFs are expected to serve investors who want to profit from their view on the market direction. But do they really?

Exchange Traded Funds' (including inverse ETFs) popularity has exploded in the last couple of years because of their passive nature and low fees. As such, they are the natural choice for buy-and-hold investing. But what if someone wants to take a directional bet on a falling market? An investor who wants to profit from the falling market can now buy an inverse ETFs.

Until recently the investors could either short an ETF or use derivatives to gain from bearish markets. However, shorting an ETF stock has some limitations. First, not all investors' trading accounts allow short positions or do not enable them to earn interests on the cash generated from shorting ETFs (short balances). Second, many investors might have policy restrictions on short trades (IRAs, for example). Short sells, theoretically at least, can expose investors to unlimited losses.

Use of derivative products such as futures, options and swaps has its limits as well. Just like with shorting ETFs it can be off limits for a certain investing policy. It requires expertise in trading the derivative markets that many stock investors lack.

Inverse ETF simplifies the procedures of taking a short position on the market. The inverse (or double inverse or leveraged) ETF can be simply bought long as any other stock. It is created to replicate the negative return of an index.

For example, if S&P 500 rises 2% in a day, an inverse ETF on S&P 500 should decrease for 2%. A double inverse (ultra short) ETF would decrease 4% while a double leveraged (ultra) ETF would increase 4%.

But just like with the commodity ETFs, investors must not be misled by the simplicity to buy these instruments. Most often they are not using short positions on stocks but derivative instruments to gain inverse exposure to indices. As such they are basically actively managed what results in higher management fees.

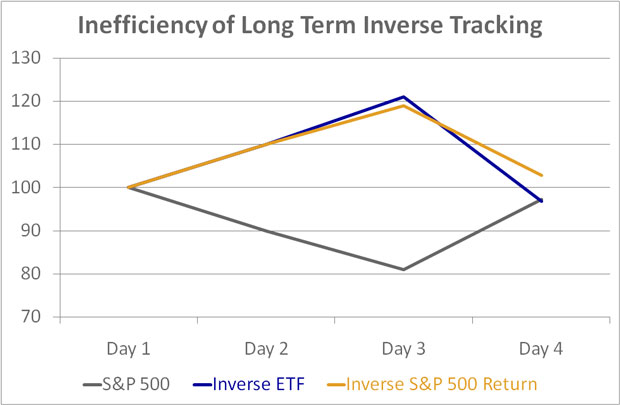

The most important aspect of an ETF is its ability to efficiently track a given index. In case of short ETFs it should be its ability to track the inverse return of index. But investors must be aware that it does not do it in the long term. Leaving aside management and transaction costs that consequently lead to tracking error, it must be strongly emphasized that tracking the inverse return is only efficient on daily basis.

Let's see why:

Imagine we have an index with value 100 on the first day. The inverse ETF's value is also 100. Next day the index drops 10% and stands at 90 at the end of the day. ETF gains 10% and is worth 110. On the second day index loses additional 10% so it is now 81. Short ETF gains 11 and is now 121 units worth. The third day index gains back 20% and reaches value of 97,2 index points. ETF loses 20% and is now worth 96,8 units. Since the index lost 2,8 % since the first day, the inverse ETF should be worth 102,8 units if it tracked the inverse return properly.

So we can see that long term (inverse) tracking becomes inefficient simply because of mathematics. This effect is intensified in volatile markets. On the other hand, a short ETF will be slowly hemorrhaging its value through management costs in a flat market while short position on ETF, for example, would not.

This issue has attracted a lot of attention lately, especially because these ETFs have gained on popularity among less experienced investors. Securities and Exchange Commission and FINRA recently issued a warning on the leveraged and inverse ETFs. Furthermore, Morningstar might decide to remove leveraged and inverse ETFs from its star ranking system, as they do not want to confuse retail investors with products not suitable for them.

There are new restrictions expected to be imposed on leveraged and inverse ETFs by the regulators. It is for now still too early to say how it will affect current ETFs on the market but it will definitely pull a break on new issuances. Needless to say, the most popular ultra and ultra short ETF issuers such as Proshares, Direxion, HorizonsBeta Pro might not be thrilled about the prospects of new regulation but it is highly unlikely that their business would suffer substantially. Inverse ETF still is a good hedging and tactical tool for experienced and sophisticated investors.

It is just the beginners, who should remember: do not use inverse ETF for buy-and-hold strategy. Or as matter of fact, do not use it at all before consulting a professional investment advisor.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

ETF Investing - Different Types Of ETFs

ETF investing offers you are a perfect investing mix, because you can choose among different types of ETFs, like index, country, sector, currency, commodity, short, leverage...

Commodity ETF - Opportunity or Threat?

Commodity ETF (Exchange Traded Fund) has been quickly gaining popularity in last couple of years while giving private investors chance to expose to commodities.

Back from Inverse ETFs to Exchange Traded Fund

Back from Inverse ETFs to Best Online Trading Site for Beginners home page