Commodity ETF - Opportunity or Threat?

Commodity ETF (Exchange Traded Fund) has been quickly gaining popularity in last couple of years while giving private investors chance to expose to commodities.

The investors have recently seen an abundance of new commodity ETFs (also known as ETCs - Exchange Traded Commodities) issuances. We are witnessing a flood of discussions and forecasts about devaluation and debasement of world currencies recently. The rationale goes that high levels of governments' debt will consequently lead to the depreciation of the indebted countries' currencies. Leaving aside the fact that currently deflation seems to be a bigger threat to global economy investors have been flocking to assets, which would protect their wealth from inflation pressures down the road. A logical choice of the day for the investors in a time of a weakened trust in paper money is a tangible asset - a commodity.

Commodities as an investment class include everything from livestock and grains on one end to rare earth elements, industrial and precious metals on the other. What most of them have in common is storage and transportation costs. For an individual investor and also for many institutional investors it would simply be too expensive, time and energy consuming to buy physical assets as it would mean transporting and storing them in specially provided premises. Therefore, the institutional investors have been using the futures contracts and options to manage their commodity exposure. However, the derivatives' techniques are too complicated for most of individual investors to indulge in.

Enter commodity ETFs. We have already discussed what is Exchange Traded Fund (ETF) and its advantages over other funds and investment vehicles. One of the exchange-traded funds' most appealing features is their simplicity to use. Buying them as any other stock on stock exchange and their low management fee has made them the most popular investment product to diversify one's portfolio. However, an investor should be aware that the mechanics of a commodity exchange traded fund is usually different to that of a stock or a bond ETF.

First, an investors should be familiar with the fact that most of ETCs are not diversified and as such do not follow the regulation set for investment funds (e.g. European UCITS III).

Second, most of commodity ETFs do not hold physical commodities in their portfolios but use futures contracts instead. Consequently, they are exposed to an additional risk; this is the counterparty risk of the futures' issuers. Remember the time after Lehman Brothers collapse in fall of 2008 when the survival of the whole financial system was at stake. An investor who had rushed in panic to, say, a gold ETF following the price of gold using futures would have lost his position in gold in case of futures' issuer bankruptcy. He would have been left with only the ETF's bad debt to the bankrupt bank. On the contrary, an investor who had invested his funds in an ETF holding physical gold (e.g. SPDR's Gold Trust) would have successfully hedged his position against a global financial meltdown. Are you interested in comparison of Gold Index ETFs?

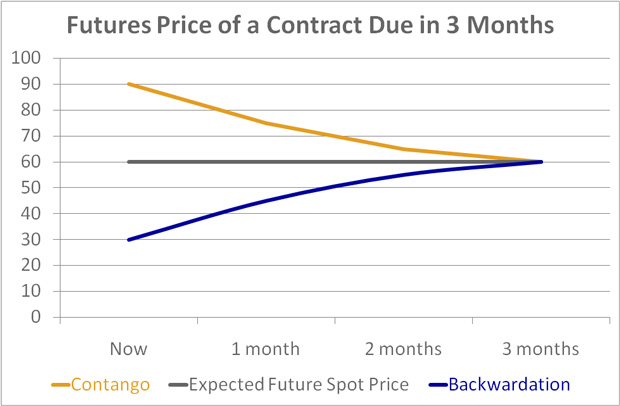

Next, it is of essential importance to understand how futures markets work. When an exchange-traded fund buys a futures contract, it pays a forward price for a commodity that will be delivered to him once in future. This forward price can differ from the expected future spot price. It will usually be higher because of warehousing costs and opportunity loss of interests forgone on funds tied up (costs of carry). This situation is called 'contango'. The opposite condition is 'backwardation'. Expected future spot price will be higher than forward price meaning that investor in a future delivery contract will realize extra profit when the contract comes due. Backwardation usually occurs when a short-term shortage of a commodity is expected by the market. It happened in 2005 and 2006 in crude oil market.

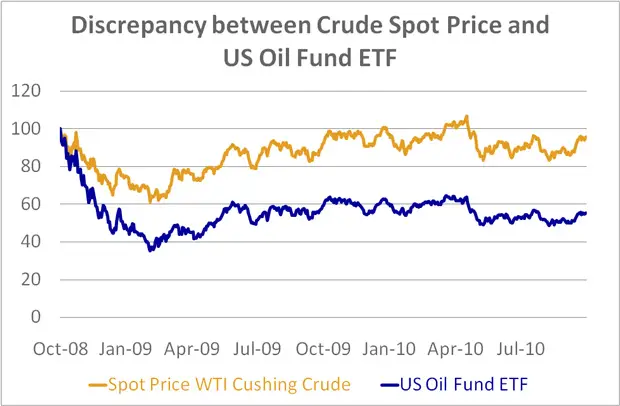

Example: A commodity ETF is buying futures on crude oil due in three months. As we approach contract the futures price converges towards the spot price. On the maturity date the futures price will equal crude spot price. If it does not, anybody could make free money with an arbitrage. The futures price is falling when approaching the maturity date even though the expected spot price remains unchanged throughout the period. When the futures contract comes due the ETF will get less for selling the commodity than he paid for the futures even if spot price remained the same. That means that every time the fund rolls over its futures in a contango market it suffers a loss. The opposite happens in normal backwardation market. Every time futures come due, the ETF will gain a convenience yield. Consequently, the commodity ETF's tracking of the commodity's spot price will be seriously compromised.

It should be added that the first commodity ETFs holding physical industrial commodities are coming to the market. So far it was mostly the precious metals that were held by the funds in their physical form as their costs of storing are far inferior to those of bulkier assets such as base metals (aluminium, zinc, lead, nickel, tin and copper). However, there are mixed reactions, at least, to the news. The storage costs for aluminium could reach 10 percent annualy. In a backwardation market that could mean a substantial opportunity loss to rolling over the futures. Rolling over the front-end nickel, lead, tin and copper futures has outperformed holding them in physical form over the last decade. Furthermore, it is hard to believe storing base metals in short supply by financial funds would not cause a political upheaval in times of a fragile global economic recovery.

There exists a more efficient way to manage the effects of contango or backwardation than holding physical assets. When rolling over the futures a commodity ETF can optimize the time horizon of futures in accordance with a given commodity forward curve in that moment.

Example: Expected future spot price for the entire period of next six months is 100 USD. Price for a futures contract coming due in one month is 110 USD. The cost of contango is 120 USD annually: (110-100) x 12. Price of a contract coming due in 12 months is 170 USD. Cost of contango is consequently only 70 USD (170-100) if a commodity ETF buys 12 month futures instead of rolling over 1 month contracts.

This method has proven to be quite efficient and is gaining followers. A commodity ETF compensates higher activity of its managers by charging a higher management fee.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

ETF Investing - Different Types Of ETFs

ETF investing offers you are a perfect investing mix, because you can choose among different types of ETFs, like index, country, sector, currency, commodity, short, leverage...

Inverse ETFs - Be Aware of the Risks

Inverse ETFs (Exchange Traded Funds, also known as short ETFs) as well as leveraged ETFs are expected to serve investors who want to profit from their view on the market direction. But do they really?

Back from Commodity ETF to Exchange Traded Fund

Back from Commodity ETF to Best Online Trading Site for Beginners home page