Currency ETF - Top 5 Exchange Traded Funds for Next Five Years

We made a research and comparison of currency ETF funds with highest potential return over the next five years, according to global economic situation.

In times like now, with high volatility in financial markets, when one recession is not yet over and the new one is knocking on the door, it is very difficult to be smart about right asset allocation. Many experienced investors recommend holding some money in equities, gold and other precious metals are also very popular, and holding part, maybe even majority of portfolio in cash is also a very often recommendation. But holding your wealth in cash opens further questions, among which the most important is in which currency you should hold your cash position. Is it U.S. Dollar, Canadian Dollar, Euro, British Pound, maybe Swedish Krona, Swiss Franc, Japanese Jen, New Zealand Dollar, Australian Dollar, Chinese Yuan, Indian Rupee, Brazilian Real or or perhaps any other not noted here? Well, power of global economies is changing. The picture of creditor and debtor nations is becoming clearer over last years. Many top world economies are losing their power, so are their currencies. New economies are here to replace them in this century.

Five Favorite Currencies for the Next Five Years

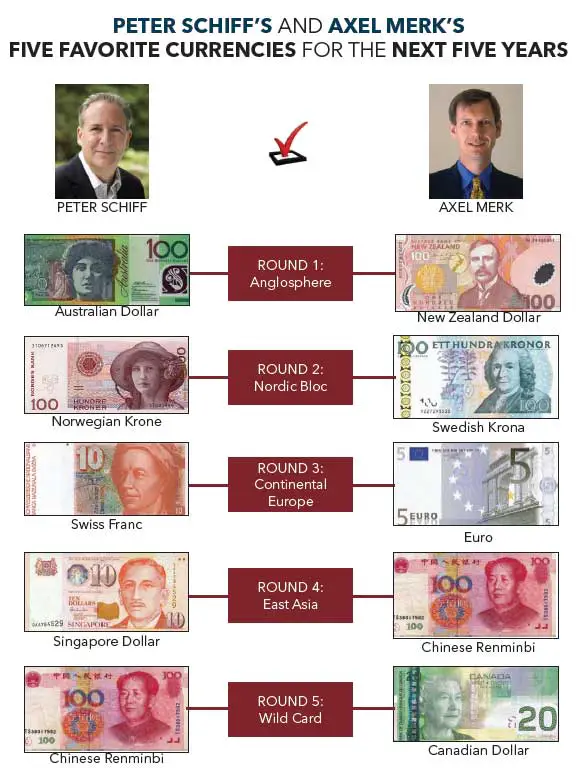

Merk Fund, the authority on currencies and Euro Pacific Capital Inc., issued a special report in October 2011: "Five Favorite Currencies for the Next Five Years"; authors are Peter Schiff & Axel Merk. This 23 pages report discloses the answer to the question in which currency you should hold your cash position. If you believe it or not, it is not the U.S. dollar, the opposite, both authors see current world currency as very vulnerable to America's unsustainable fiscal imbalances. They recommend holding cash in hard currencies of those nations, whose economies are healthy and have growth long-term prospects and low risk of hyperinflation. Peter and Alex have grouped the currencies in four regional categories: the Anglo sphere, the Nordic Bloc, Continental Europe, and East Asia. Within each category each author has picked his favorite currency for the next five years. Would you like to know the results? OK, we will summarize it for you; however we do strongly recommend you to read the whole report.

In Anglo sphere or so called English speaking countries with stable governance, rule of law, strong property rights, minimal corruption, abundant natural resources, and relatively low or shrinking public debt, they prefer the strongest countries (Australia, Canada and New Zealand) over the weakest (United States and United Kingdom). Peter's favorite is Australian Dollar, while Alex's favorite currency is New Zealand Dollar.

In the Nordic bloc that is mainly focused on region of Scandinavia, with welfare states, transparent markets, natural resources, and attractive place to do business, Peter and Alex both like Swedish and Norwegian Krona.

In Continental Europe with mixed economies, high taxes, high regulation, low growth, and cradle of civilization, where the biggest monetary project of last two decades was establishment of uniform currency, Euro, countries are beginning to separate on stronger and weaker economies. Euro is challenged nowadays as never before, Switzerland with Franc is providing independence and alternative in currency terms. Alex prefers Euro, while Peter's favorite is Swiss Franc.

East Asia is the region with highest growth for the past several decades, however governments of these countries are providing poor civil liberty, legal systems are questionable and suspect of high corruption and unreliability is present. With many risks in so called Wild West, also great opportunities are there to strike rich. Peter's favorite currency in this region is Singapore Dollar, while Alex's choice is Chinese Renminbi.

As the fifth currency, so called wild card, Alex has choosen Canadian Dollar and Peter has picked Chinese Renminbi.

Again, all the credit for this great content and thank for sharing it with people goes to http://www.merkfunds.com/ and http://www.europac.net/.

Currency ETF Portfolio for the Next Five Years

We wanted to upgrade findings in the report just presented above with concrete possibilities of investing in Exchange Traded Funds (currency ETF). We have on purpose avoided possibilities of direct Forex investments, ETNs and other derivatives, which are leverages or carry issuer's default risk. We would like to present the less risky possibility to expose to recommended currencies via the stock market. Our source for currency ETF comparison was ETFdb.com. We have removed the ETN's of that list, and based on funds portfolios, their expenses, dividend yields, we have picked the top 5 of them based on our private opinion. Here is the list in the table below:

| Ticker (chart) |

Currency ETF (link to fund provider) |

FX Pair | Expense Ratio | Annual Dividend Yield % |

|---|---|---|---|---|

| FXA |

CurrencyShares Australian Dollar Trust | AUD/USD | 0.40% | 4.05% |

| FXC |

CurrencyShares Canadian Dollar Trust | CAD/USD | 0.40% | 0.15% |

| FXF |

CurrencyShares Swiss Franc Trust | CHF/USD | 0.40% | 0.00% |

| FXS |

CurrencyShares Swedish Krona Trust | SEK/USD | 0.40% | 1.15% |

| CCX |

WisdomTree Dreyfus Commodity Currency Fund | Basket*/USD | 0.55% | N/A |

* Basket consists of the following curriencies: Australian Dollar, Brazilian Real, Canadian Dollar, Chilean Peso, Norwegian Krone, New Zealand Dollar, Russian Ruble and South African Rand.

Like always, we recommend you to get professional advice weather this currency ETF list is suitable for your private portfolio or not. Hopefully you find this article useful; if so, do not forget to share it and recommend it to other visitors.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

China ETF Opportunities - Which One to Select?

Selecting appropriate China ETF can be crucial when you are looking for a way to get exposed to this highly growth country with endless opportunities.

Comparison of India ETF and ETN Opportunities

Selecting large-cap India ETF is only one of many possible ways to get exposed to Indian stock market. You can also invest in small-cap, inverse, leverage or ETN.

Back from Currency ETF to Exchange Traded Fund

Back from Currency ETF to Best Online Trading Site for Beginners Home Page