Different Ways to Invest Money

Different ways to invest money exist out there and everybody has to make a right combination of them to create a perfect investment portfolio.

There are many possible ways to invest money today. Some of them are more traditional, conservative in term of risk and others are more focused on higher yields. If you are reading this article, I assume you already did take care of your debt and build your emergency fund and now you are looking for the best way to invest money.

Weather it is time of economic contraction or expansion, it can be confusing to determine the best ways to invest money wisely. The key steps are to make a financial plan, diversify your investments, and determine perfect asset allocation. Finally, you have to continually rebalance your portfolio.

Make a Financial Plan

Your financial goals must be clearly defined before you can decide which combination of ways to invest money is right for you and will be determined by things like your age, your regular incomes and your tolerance for risk. The lower you investment horizon is and the lower your regular incomes are and the lower your risk tolerance is, the more you should invest in lower-risk, more liquid assets and vice versa.

Diversify Your Investments

What combination of different ways to invest money is perfect for you?

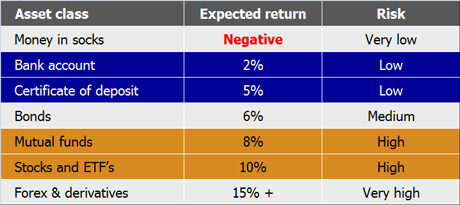

It depends on many aspects, but here is the matrix of expected returns and risk...

Warning! Expected return is simply one point on the spectrum of possible returns and outcome becomes more and more likely over longer periods; but even there's no way to truly calculate the probability of any given outcome.

There are several different ways to invest money, including traditional bank savings, bonds, stocks, commodities and real estate. Because all investment involves an element of risk, the wisest way to invest your money is to diversify. This means reducing risk by spreading your investments among several different assets and even within each asset class (for example while investing in stocks, it is wise to take care of regional and industry diversification).

Holding Money at Home

Many people do not trust in different possible ways to invest money. They rather hold their money at home. But you must be aware of the cost for holding money at home. It is not only the problem that you are not earning anything with this money, you are losing, and I mean losing a lot of money on the long run. The problem is inflation. Almost every country in the world has inflation, which simply means that prices of goods and services you are buying every day are rising over time. Because of that, your $100 today will be actually worth less after one or even more years in terms of buying power. This is the worst way to invest money!

Some people hold money at home in foreign currency. Currency market is the biggest market in the world. Exchange rates between currency pairs are changing over time and reflecting the economic strength of each country. Is it dollar, euro, yen or maybe some other currency that will appreciate the most in the next decade? Like with other investments, it is hard to say and nothing is definite since things are changing. One of the smart ways to invest money is diversifying risk over different currencies, although the majority of your savings should stay in the currency you live and spend the most. But remember, currency diversification can be done through all investment classes (savings, stocks, etc.). If you only diversify your cash at home in different currencies, you haven't done much!

Bank Account

One of the most known ways to invest money is the conservative bank account. Bank savings are known as high-liquid, low-risk and low-yield investments. You can expect about 2% a year for the money you have in your account, which is not a very high return, but it is an easy way to start.

Certificate of Deposit

Another type of investment is the certificate of deposit (CD). CD's are a type of lending investment, where you lend your money to a bank for a specific time, say 12 months, and they give you your money back with an interest rate of 5% compounded onto that amount. CD's are a guaranteed safe investment.

Bonds

Bonds are another type of lending investment similar to CD's. Bonds can be issued by a state, bank or company and can be short, medium or long-term. Bond yields depend on the maturity and quality of the issuer and are lower for state bonds (around 4%) and can go much higher (8% and more) for more risky corporate bonds.

Stocks and ETF's

The best way to make your money grow on the long-term is through the stock market. Historically the stock market has on average returned 10% annually (7% capital gain plus 3% dividend yield). However, the stock market is volatile and you can lose a lot of your money us inexperienced investor. You must realize that risk and return go hand-in-hand.

Exchange Traded Funds (ETFs) are one of the most popular ways to invest money in the last decade. They combine mutual funds advantage of portfolio diversification and since their investment strategy is passive (they are just following one of the indices), their management fee is very low, which brings them better long-term results. And since ETFs are quoted on exchanges, they became a popular trading instrument also.

Stocks for Low Budgets - Direct Investments or Mutual Funds

Do you only have smaller amounts of money to invest every month? The problem is that stockbrokers normally have minimum commissions for executing trades and are there for not suitable for smaller monthly investments. In this case you can choose well known investment in mutual funds or choose among different types of direct investing, like Direct Purchase Plan (DPP) and a Dividend Reinvestment Plan (DRIP). Both are no-load stocks and in both cases the individual investor can buy stock directly from the company without going through a broker. However, to buy a DRIP, you need to already own stock to reinvest your dividend as more stock. With a DPP, you can be a first-time buyer.

Mutual funds are the most massive way to invest money in stocks. A mutual fund is a professionally managed type of collective investment scheme that pools money from many investors and invests typically in investment securities (stocks, bonds, short-term money market instruments, other mutual funds, other securities, and/or commodities such as precious metals). Mutual funds have a fund manager that trades (buys and sells) the fund's investments in accordance with the fund's investment objective. The major advantage of mutual funds is that you can buy already diversified investment with relatively low entrance cost without minimum fees. The major disadvantage is their high management fee, which is killing your long-term gains and there is always a question of how professional these funds are managed.

Forex, Options, Futures and Other Derivatives

Forex and derivatives are high-risk instruments not suitable for everyone. These instruments can be used for hedging on one hand or trading speculation on the other. All these instruments are traded on margin (leverage) and higher gains and losses are possible in a short period of time. Money saving experts advice only experienced investors to trade this instruments and even for them it is recommended to trade them only in a smaller part of their investment portfolio (usually less then 10%).

Allocate a Percentage of Your Money to Each Asset Class

Your perfect investment portfolio will be build out of different ways to invest money. Just buying equal sums of each type of asset is not a wise investment strategy. If you are willing to take some risk in exchange for the possibility of higher returns, for example, you might allocate a larger percentage of your investment portfolio to stocks and a small percentage to savings accounts like Certificates of Deposit (CDs). On the other hand, if you are looking for security over quick profits, you may want to dedicate a large part of your portfolio in liquid accounts, some types of bonds, and a only a tiny portion in stocks.

Periodically Reevaluate Your Portfolio

As your portfolio grows over time, you may find that certain assets have increased in value more than others. Allowing your portfolio to grow without rebalancing it means more of your money might end up in one type of asset, increasing the danger that you could lose a great deal if that industry crashes. This can easily happen with stocks, commodities, and even real estate. The solution is to consistently review your portfolio and keep it in harmony with your financial goals. If, for example, commodities now comprise 25 percent of your portfolio and you originally wanted them to account for only 15 percent, you should sell off some of them and put the money back into other asset classes.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Ways to Invest Money to How to Invest in Stock

Back from Ways to Invest Money to Best Online Trading Site for Beginners home page