Stock Market Results and the Zero Sum Game

No matter if stock market results like the zero sum game or not, you have to be aware of importance of costs and taxes in investing process.

There is an ongoing debate among investment academics weather investing in stock market results above or equal to zero, when all the investor's profits and losses are summed. The debate is well known as "the zero sum game in stock market investing".

A zero-sum-game is a situation in which one participant's gains result only from another participant's equivalent losses. The net change in total wealth among participants is zero; the wealth is just shifted from one to another.

Those who say that investing in stock market results above zero point to the fact that the overall market tends to raise in value over time, therefore most investors are statistically predestined to be winners should they hold their positions over the long-term.

Those who say that investing in stock market results in aggregate zero point to the fact that there is a winner and a loser to every trade. If an investor buys a stock and it goes up, he/she has won and the person who sold the stock has lost in an equal amount. The winner and loser roles are reversed if the stock goes down.

While gambling or options and future contracts are clear examples of zero-sum games (excluding costs) there is obviously more complicated stuff with stock market results. Both arguments are correct and missing some information at the same time. Opponents of zero sum game ignore the fact that when any seller cashes out a stock position and registers a big profit, the investor who buys the position actually takes a notional loss because theoretically he/she could also have bought in earlier at the lower price. Supporters of zero sum game miss the fact that dividend payments add to the return on investment with a stream of income in such a way that the "pot" is constantly sweetened, thereby increase the overall return all investors beyond the simple capital gain of a purchase and later sale.

Stock market results can make the zero-sum-game even negative, if you consider the impact of costs and taxes on investment returns. Therefore it is very difficult for active managers/investors to outperform the market. No matter, if you are supporter or opponent of stock investing zero sum game, you have to be aware of importance of costs and taxes in investing process, since they have great impact on your final return.

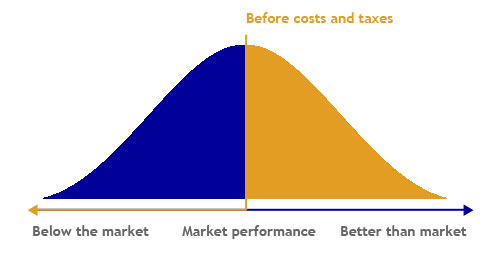

Before Cost Distribution Of Returns

The bell curve shown represents a typical distribution of market securities returns. Market performance is the midpoint – 50 per cent of returns are better than the market and conversely 50 per cent of returns are below the market. This is known as the zero sum game – for every winner there is an equal loser.

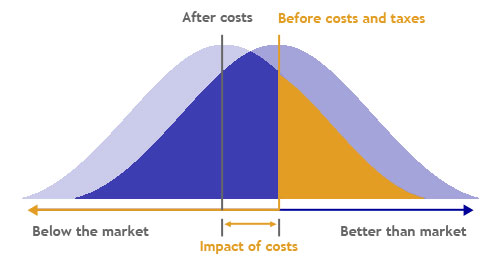

After Cost Distribution Of Returns

All investments incur costs when assets are purchased or sold. When costs are taken into account the distribution bell curve moves to the left of the midpoint on the chart. The chance of outperforming "after costs" becomes more difficult as shown by the reduced area on the picture (in red). Keeping costs to a minimum gives your portfolio a clear advantage.

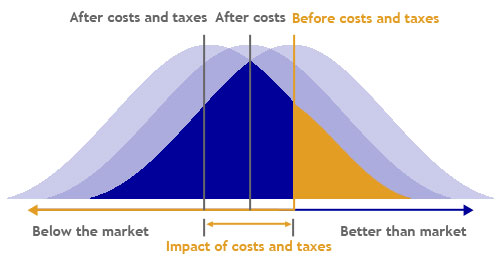

After Tax And Cost Distribution Of Returns

Tax can have a substantial effect on overall results. When both tax and costs are taken into account, the bell curve moves even further to the left. The challenge to outperform the market after costs and taxes becomes even more difficult as shown by the smaller area on the picture (in red). Investment funds that minimize management costs and optimize tax efficiency offer a distinct advantage.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Stock Market Results to Stock Market Basics

Back from Stock Market Results to Best Online Trading Site for Beginners home page