S&P 500 Index

The S&P 500 Index is a free-float capitalization-weighted index, which includes 500 large-cap common stocks traded actively in the United States.

The S&P 500 index, also known as S&P 500, SP500 or Standard & Poor's 500 index, includes 500 large-cap common public stocks actively traded in the U.S. stock exchanges. After the Dow Jones Industrial Average, the S&P 500 index is the most widely followed index of large-cap U.S. stocks, capturing 75% coverage of U.S. equities. It is considered a bellwether for the American economy, as it is includes both growth stocks and the generally less volatile value stocks.

Calculation Of Index

The S&P 500 index has traditionally been market-value weighted, meaning, movements in the prices of stocks with higher market capitalizations have a greater effect on the index than companies with smaller market caps. Since 2005 the S&P 500 index is float weighted. That is, Standard & Poor's now calculates the market caps relevant to the index using only the number of "float" shares, which are available for public trading.

Selection Of Index Components

The S&P 500 index is focused on U.S.-based publicly traded companies, although there are a few legacy companies with headquarters in other countries. The stocks included in the S&P 500 are those of large publicly held companies that trade on either of the two largest American stock market companies; the NYSE Euronext and the NASDAQ OMX. The components of the S&P 500 index are selected by committee, so they are representative of the industries in the United States economy.

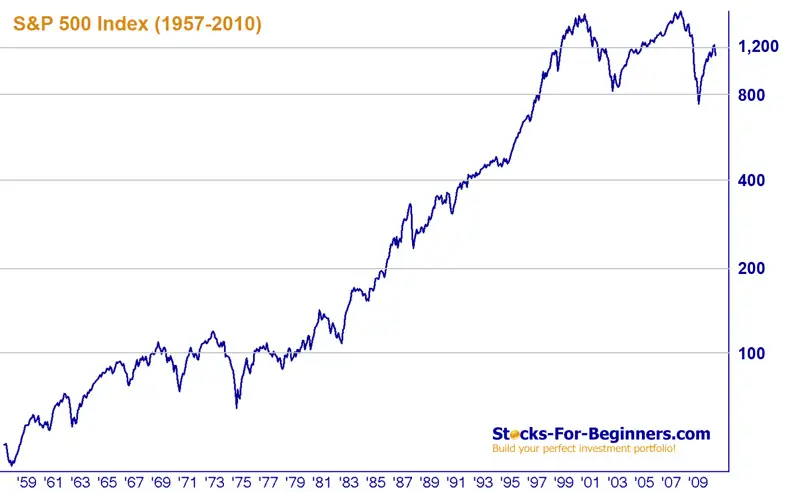

Index Historical Chart

The S&P 500 index in its present is published since 03-04-1957. S&P 500 index reached all-time highs just before the last financial crisis on 09-11-2007, when index reached intraday level of 1,576.09 points. The latest minimal value of the index was reached in March 2009, when index fell below the 680 level.

Index Sector Allocation

The S&P 500 index has the following sector allocation (as of 5/28/2010):

- Information Technology: 18.81%

- Financials: 16.44%

- Health Care: 11.63%

- Consumer Staples: 11.22%

- Energy: 10.82%

- Consumer Discretionary: 10.69%

- Industrials: 10.59%

- Utilities: 3.52%

- Materials: 3.44%

- Telecommunication Services: 2.84%

Index Components

The S&P 500 index components shown in table below are sorted by weightings and valid as of 5/28/2010.

| Company | Symbol | Sector | Weight |

|---|---|---|---|

| Exxon Mobil Corp | XOM | Energy | 2.90% |

| Apple Inc | AAPL | Information Technology | 2.36% |

| Microsoft Corp | MSFT | Information Technology | 2.00% |

| Procter & Gamble Co | PG | Consumer Staples | 1.80% |

| General Electric Co | GE | Industrials | 1.77% |

| International Business Mach | IBM | Information Technology | 1.65% |

| Johnson & Johnson | JNJ | Health Care | 1.63% |

| Bank Of America Corporation | BAC | Financials | 1.60% |

| Jpmorgan Chase & Co | JPM | Financials | 1.60% |

| Wells Fargo & Co New | WFC | Financials | 1.51% |

| Chevron Corp New | CVX | Energy | 1.51% |

| At&T Inc | T | Telecommunication Services | 1.46% |

| Cisco Sys Inc | CSCO | Information Technology | 1.35% |

| Pfizer Inc | PFE | Health Care | 1.25% |

| Coca Cola Co | KO | Consumer Staples | 1.20% |

| Intel Corp | INTC | Information Technology | 1.20% |

| Google Inc | GOOG | Information Technology | 1.19% |

| Berkshire Hathaway Inc Del | BRK.B | Financials | 1.19% |

| Hewlett Packard Co | HPQ | Information Technology | 1.10% |

| Wal Mart Stores Inc | WMT | Consumer Staples | 1.10% |

| Merck & Co Inc New | MRK | Health Care | 1.07% |

| Pepsico Inc | PEP | Consumer Staples | 1.04% |

| Oracle Corp | ORCL | Information Technology | 0.90% |

| Philip Morris Intl Inc | PM | Consumer Staples | 0.84% |

| Verizon Communications Inc | VZ | Telecommunication Services | 0.79% |

| Citigroup Inc | C | Financials | 0.79% |

| Conocophillips | COP | Energy | 0.78% |

| Goldman Sachs Group Inc | GS | Financials | 0.77% |

| Abbott Labs | ABT | Health Care | 0.75% |

| Mcdonalds Corp | MCD | Consumer Discretionary | 0.73% |

| Schlumberger Ltd | SLB | Energy | 0.68% |

| Occidental Pete Corp Del | OXY | Energy | 0.68% |

| Disney Walt Co | DIS | Consumer Discretionary | 0.66% |

| United Technologies Corp | UTX | Industrials | 0.64% |

| United Parcel Service Inc | UPS | Industrials | 0.63% |

| Qualcomm Inc | QCOM | Information Technology | 0.61% |

| Home Depot Inc | HD | Consumer Discretionary | 0.58% |

| 3M Co | MMM | Industrials | 0.57% |

| Comcast Corp New | CMCSA | Consumer Discretionary | 0.52% |

| Amgen Inc | AMGN | Health Care | 0.51% |

| Kraft Foods Inc | KFT | Consumer Staples | 0.50% |

| Boeing Co | BA | Industrials | 0.49% |

| Cvs Caremark Corporation | CVS | Consumer Staples | 0.49% |

| American Express Co | AXP | Financials | 0.48% |

| Us Bancorp Del | USB | Financials | 0.47% |

| Medtronic Inc | MDT | Health Care | 0.44% |

| Amazon Com Inc | AMZN | Consumer Discretionary | 0.44% |

| Altria Group Inc | MO | Consumer Staples | 0.43% |

| Target Corp | TGT | Consumer Discretionary | 0.42% |

| Bristol Myers Squibb Co | BMY | Health Care | 0.40% |

| Ford Mtr Co Del | F | Consumer Discretionary | 0.40% |

| Colgate Palmolive Co | CL | Consumer Staples | 0.39% |

| E M C Corp Mass | EMC | Information Technology | 0.39% |

| Caterpillar Inc Del | CAT | Industrials | 0.39% |

| Morgan Stanley | MS | Financials | 0.38% |

| Lowes Cos Inc | LOW | Consumer Discretionary | 0.37% |

| Union Pac Corp | UNP | Industrials | 0.37% |

| Time Warner Inc | TWX | Consumer Discretionary | 0.36% |

| Directv | DTV | Consumer Discretionary | 0.36% |

| Emerson Elec Co | EMR | Industrials | 0.35% |

| Unitedhealth Group Inc | UNH | Health Care | 0.34% |

| Lilly Eli & Co | LLY | Health Care | 0.34% |

| Metlife Inc | MET | Financials | 0.34% |

| Freeport-Mcmoran Copper & G | FCX | Materials | 0.33% |

| Bank Of New York Mellon Cor | BK | Financials | 0.33% |

| Honeywell Intl Inc | HON | Industrials | 0.33% |

| Du Pont E I De Nemours & Co | DD | Materials | 0.33% |

| Pnc Finl Svcs Group Inc | PNC | Financials | 0.33% |

| Gilead Sciences Inc | GILD | Health Care | 0.33% |

| Visa Inc | V | Information Technology | 0.33% |

| Walgreen Co | WAG | Consumer Staples | 0.32% |

| Dow Chem Co | DOW | Materials | 0.31% |

| Texas Instrs Inc | TXN | Information Technology | 0.31% |

| Apache Corp | APA | Energy | 0.31% |

| News Corp | NWSA | Consumer Discretionary | 0.30% |

| Devon Energy Corp New | DVN | Energy | 0.29% |

| Nike Inc | NKE | Consumer Discretionary | 0.29% |

| Monsanto Co New | MON | Materials | 0.28% |

| Express Scripts Inc | ESRX | Health Care | 0.28% |

| Corning Inc | GLW | Information Technology | 0.28% |

| Prudential Finl Inc | PRU | Financials | 0.27% |

| Southern Co | SO | Utilities | 0.27% |

| Medco Health Solutions Inc | MHS | Health Care | 0.27% |

| Eog Res Inc | EOG | Energy | 0.27% |

| Newmont Mining Corp | NEM | Materials | 0.27% |

| General Dynamics Corp | GD | Industrials | 0.27% |

| Fedex Corp | FDX | Industrials | 0.27% |

| Anadarko Pete Corp | APC | Energy | 0.26% |

| Costco Whsl Corp New | COST | Consumer Staples | 0.26% |

| Exelon Corp | EXC | Utilities | 0.26% |

| Baxter Intl Inc | BAX | Health Care | 0.26% |

| Travelers Companies Inc | TRV | Financials | 0.26% |

| Kimberly Clark Corp | KMB | Consumer Staples | 0.26% |

| Lockheed Martin Corp | LMT | Industrials | 0.26% |

| Xto Energy Inc | XTO | Energy | 0.25% |

| Simon Ppty Group Inc New | SPG | Financials | 0.25% |

| Deere & Co | DE | Industrials | 0.25% |

| Celgene Corp | CELG | Health Care | 0.25% |

| Ebay Inc | EBAY | Information Technology | 0.25% |

| Praxair Inc | PX | Materials | 0.24% |

| General Mls Inc | GIS | Consumer Staples | 0.24% |

| Dominion Res Inc Va New | D | Utilities | 0.24% |

| Dell Inc | DELL | Information Technology | 0.23% |

| Wellpoint Inc | WLP | Health Care | 0.23% |

| Halliburton Co | HAL | Energy | 0.23% |

| Marathon Oil Corp | MRO | Energy | 0.22% |

| Thermo Fisher Scientific In | TMO | Health Care | 0.22% |

| Cme Group Inc | CME | Financials | 0.21% |

| Duke Energy Corp New | DUK | Utilities | 0.21% |

| Bb&T Corp | BBT | Financials | 0.21% |

| Norfolk Southern Corp | NSC | Industrials | 0.21% |

| Danaher Corp Del | DHR | Industrials | 0.21% |

| Aflac Inc | AFL | Financials | 0.21% |

| Automatic Data Processing I | ADP | Information Technology | 0.21% |

| Fpl Group Inc | FPL | Utilities | 0.21% |

| Viacom Inc New | VIA.B | Consumer Discretionary | 0.21% |

| Csx Corp | CSX | Industrials | 0.21% |

| Raytheon Co | RTN | Industrials | 0.20% |

| Mastercard Inc | MA | Information Technology | 0.20% |

| Time Warner Cable Inc | TWC | Consumer Discretionary | 0.20% |

| Starbucks Corp | SBUX | Consumer Discretionary | 0.20% |

| Yum Brands Inc | YUM | Consumer Discretionary | 0.20% |

| Johnson Ctls Inc | JCI | Consumer Discretionary | 0.19% |

| Tjx Cos Inc New | TJX | Consumer Discretionary | 0.19% |

| State Str Corp | STT | Financials | 0.19% |

| Mckesson Corp | MCK | Health Care | 0.19% |

| Capital One Finl Corp | COF | Financials | 0.19% |

| Allergan Inc | AGN | Health Care | 0.19% |

| Northrop Grumman Corp | NOC | Industrials | 0.19% |

| Yahoo Inc | YHOO | Information Technology | 0.19% |

| Illinois Tool Wks Inc | ITW | Industrials | 0.18% |

| Sysco Corp | SYY | Consumer Staples | 0.18% |

| Applied Matls Inc | AMAT | Information Technology | 0.18% |

| Adobe Sys Inc | ADBE | Information Technology | 0.17% |

| Becton Dickinson & Co | BDX | Health Care | 0.17% |

| Precision Castparts Corp | PCP | Industrials | 0.17% |

| Chubb Corp | CB | Financials | 0.17% |

| Allstate Corp | ALL | Financials | 0.17% |

| Baker Hughes Inc | BHI | Energy | 0.17% |

| American Tower Corp | AMT | Telecommunication Services | 0.17% |

| Archer Daniels Midland Co | ADM | Consumer Staples | 0.16% |

| Schwab Charles Corp New | SCHW | Financials | 0.16% |

| National Oilwell Varco Inc | NOV | Energy | 0.16% |

| Motorola Inc | MOT | Information Technology | 0.16% |

| Waste Mgmt Inc Del | WM | Industrials | 0.16% |

| Carnival Corp | CCL | Consumer Discretionary | 0.16% |

| Staples Inc | SPLS | Consumer Discretionary | 0.16% |

| Kohls Corp | KSS | Consumer Discretionary | 0.16% |

| Public Svc Enterprise Group | PEG | Utilities | 0.16% |

| Hess Corp | HES | Energy | 0.16% |

| Pg&E Corp | PCG | Utilities | 0.16% |

| American Elec Pwr Inc | AEP | Utilities | 0.16% |

| Sprint Nextel Corp | S | Telecommunication Services | 0.16% |

| Stryker Corp | SYK | Health Care | 0.15% |

| Paccar Inc | PCAR | Industrials | 0.15% |

| Cognizant Technology Soluti | CTSH | Information Technology | 0.15% |

| Broadcom Corp | BRCM | Information Technology | 0.15% |

| Air Prods & Chems Inc | APD | Materials | 0.15% |

| Chesapeake Energy Corp | CHK | Energy | 0.15% |

| Franklin Res Inc | BEN | Financials | 0.15% |

| Best Buy Inc | BBY | Consumer Discretionary | 0.15% |

| Entergy Corp New | ETR | Utilities | 0.14% |

| Juniper Networks Inc | JNPR | Information Technology | 0.14% |

| Heinz H J Co | HNZ | Consumer Staples | 0.14% |

| Cummins Inc | CMI | Industrials | 0.14% |

| Kellogg Co | K | Consumer Staples | 0.14% |

| Nucor Corp | NUE | Materials | 0.14% |

| Suntrust Bks Inc | STI | Financials | 0.14% |

| Progressive Corp Ohio | PGR | Financials | 0.13% |

| Kroger Co | KR | Consumer Staples | 0.13% |

| Southwestern Energy Co | SWN | Energy | 0.13% |

| Netapp Inc | NTAP | Information Technology | 0.13% |

| Spectra Energy Corp | SE | Energy | 0.13% |

| Genzyme Corp | GENZ | Health Care | 0.13% |

| Coach Inc | COH | Consumer Discretionary | 0.13% |

| Price T Rowe Group Inc | TROW | Financials | 0.13% |

| Biogen Idec Inc | BIIB | Health Care | 0.13% |

| Equity Residential | EQR | Financials | 0.13% |

| Xerox Corp | XRX | Information Technology | 0.13% |

| Public Storage | PSA | Financials | 0.13% |

| Aetna Inc New | AET | Health Care | 0.13% |

| Intuitive Surgical Inc | ISRG | Health Care | 0.13% |

| Cardinal Health Inc | CAH | Health Care | 0.13% |

| Northern Tr Corp | NTRS | Financials | 0.12% |

| Vornado Rlty Tr | VNO | Financials | 0.12% |

| St Jude Med Inc | STJ | Health Care | 0.12% |

| Consolidated Edison Inc | ED | Utilities | 0.12% |

| Zimmer Hldgs Inc | ZMH | Health Care | 0.12% |

| Alcoa Inc | AA | Materials | 0.12% |

| Omnicom Group Inc | OMC | Consumer Discretionary | 0.12% |

| Bed Bath & Beyond Inc | BBBY | Consumer Discretionary | 0.12% |

| Marsh & Mclennan Cos Inc | MMC | Financials | 0.12% |

| Eaton Corp | ETN | Industrials | 0.12% |

| Loews Corp | L | Financials | 0.12% |

| Williams Cos Inc Del | WMB | Energy | 0.12% |

| Symantec Corp | SYMC | Information Technology | 0.12% |

| Sempra Energy | SRE | Utilities | 0.12% |

| Avon Prods Inc | AVP | Consumer Staples | 0.11% |

| Agilent Technologies Inc | A | Information Technology | 0.11% |

| Intuit | INTU | Information Technology | 0.11% |

| Ecolab Inc | ECL | Materials | 0.11% |

| Hartford Finl Svcs Group In | HIG | Financials | 0.11% |

| Lorillard Inc | LO | Consumer Staples | 0.11% |

| Progress Energy Inc | PGN | Utilities | 0.11% |

| Western Un Co | WU | Information Technology | 0.11% |

| Firstenergy Corp | FE | Utilities | 0.11% |

| Conagra Foods Inc | CAG | Consumer Staples | 0.11% |

| Discovery Communicatns New | DISCA | Consumer Discretionary | 0.11% |

| Sandisk Corp | SNDK | Information Technology | 0.11% |

| Boston Properties Inc | BXP | Financials | 0.11% |

| Ppg Inds Inc | PPG | Materials | 0.11% |

| Valero Energy Corp New | VLO | Energy | 0.11% |

| Edison Intl | EIX | Utilities | 0.11% |

| Aon Corp | AON | Financials | 0.11% |

| Peabody Energy Corp | BTU | Energy | 0.11% |

| Gap Inc Del | GPS | Consumer Discretionary | 0.11% |

| Noble Energy Inc | NBL | Energy | 0.11% |

| Fifth Third Bancorp | FITB | Financials | 0.10% |

| Centurytel Inc | CTL | Telecommunication Services | 0.10% |

| Murphy Oil Corp | MUR | Energy | 0.10% |

| Ameriprise Finl Inc | AMP | Financials | 0.10% |

| Mead Johnson Nutrition Co | MJN | Consumer Staples | 0.10% |

| Intl Paper Co | IP | Materials | 0.10% |

| Parker Hannifin Corp | PH | Industrials | 0.10% |

| Cbs Corp New | CBS | Consumer Discretionary | 0.10% |

| Ppl Corp | PPL | Utilities | 0.10% |

| C H Robinson Worldwide Inc | CHRW | Industrials | 0.10% |

| Dr Pepper Snapple Group Inc | DPS | Consumer Staples | 0.10% |

| L-3 Communications Hldgs In | LLL | Industrials | 0.10% |

| Salesforce Com Inc | CRM | Information Technology | 0.10% |

| Sara Lee Corp | SLE | Consumer Staples | 0.10% |

| Republic Svcs Inc | RSG | Industrials | 0.10% |

| Hcp Inc | HCP | Financials | 0.10% |

| Xcel Energy Inc | XEL | Utilities | 0.09% |

| Macys Inc | M | Consumer Discretionary | 0.09% |

| Smith Intl Inc | SII | Energy | 0.09% |

| Host Hotels & Resorts Inc | HST | Financials | 0.09% |

| Southwest Airls Co | LUV | Industrials | 0.09% |

| Cigna Corp | CI | Health Care | 0.09% |

| Rockwell Collins Inc | COL | Industrials | 0.09% |

| Paychex Inc | PAYX | Information Technology | 0.09% |

| Boston Scientific Corp | BSX | Health Care | 0.09% |

| Regions Financial Corp New | RF | Financials | 0.09% |

| Fidelity Natl Information S | FIS | Information Technology | 0.09% |

| Life Technologies Corp | LIFE | Health Care | 0.09% |

| Weyerhaeuser Co | WY | Materials | 0.09% |

| Cameron International Corp | CAM | Energy | 0.09% |

| Amerisourcebergen Corp | ABC | Health Care | 0.09% |

| Itt Corp New | ITT | Industrials | 0.09% |

| Reynolds American Inc | RAI | Consumer Staples | 0.09% |

| Clorox Co Del | CLX | Consumer Staples | 0.09% |

| Stanley Black & Decker Inc | SWK | Consumer Discretionary | 0.09% |

| Mcgraw Hill Cos Inc | MHP | Consumer Discretionary | 0.09% |

| Priceline Com Inc | PCLN | Consumer Discretionary | 0.09% |

| Principal Finl Group Inc | PFG | Financials | 0.09% |

| Goodrich Corp | GR | Industrials | 0.09% |

| Analog Devices Inc | ADI | Information Technology | 0.09% |

| Starwood Hotels&Resorts Wrl | HOT | Consumer Discretionary | 0.09% |

| Safeway Inc | SWY | Consumer Staples | 0.09% |

| Intercontinentalexchange In | ICE | Financials | 0.09% |

| Hospira Inc | HSP | Health Care | 0.09% |

| Marriott Intl Inc New | MAR | Consumer Discretionary | 0.09% |

| Fluor Corp New | FLR | Industrials | 0.09% |

| Dover Corp | DOV | Industrials | 0.08% |

| Coca Cola Enterprises Inc | CCE | Consumer Staples | 0.08% |

| Expeditors Intl Wash Inc | EXPD | Industrials | 0.08% |

| Citrix Sys Inc | CTXS | Information Technology | 0.08% |

| Ca Inc | CA | Information Technology | 0.08% |

| Lincoln Natl Corp Ind | LNC | Financials | 0.08% |

| Consol Energy Inc | CNX | Energy | 0.08% |

| Avalonbay Cmntys Inc | AVB | Financials | 0.08% |

| Invesco Ltd | IVZ | Financials | 0.08% |

| Western Digital Corp | WDC | Information Technology | 0.08% |

| El Paso Corp | EP | Energy | 0.08% |

| Quest Diagnostics Inc | DGX | Health Care | 0.08% |

| Laboratory Corp Amer Hldgs | LH | Health Care | 0.08% |

| Mattel Inc | MAT | Consumer Discretionary | 0.08% |

| Questar Corp | STR | Utilities | 0.08% |

| Humana Inc | HUM | Health Care | 0.08% |

| Forest Labs Inc | FRX | Health Care | 0.08% |

| Whirlpool Corp | WHR | Consumer Discretionary | 0.08% |

| Qwest Communications Intl I | Q | Telecommunication Services | 0.08% |

| Hershey Co | HSY | Consumer Staples | 0.08% |

| Bard C R Inc | BCR | Health Care | 0.08% |

| Micron Technology Inc | MU | Information Technology | 0.08% |

| Unum Group | UNM | Financials | 0.08% |

| Computer Sciences Corp | CSC | Information Technology | 0.08% |

| Rockwell Automation Inc | ROK | Industrials | 0.08% |

| Genworth Finl Inc | GNW | Financials | 0.08% |

| Cliffs Natural Resources In | CLF | Materials | 0.08% |

| Dte Energy Co | DTE | Utilities | 0.08% |

| Nyse Euronext | NYX | Financials | 0.08% |

| Pioneer Nat Res Co | PXD | Energy | 0.07% |

| Ventas Inc | VTR | Financials | 0.07% |

| Amphenol Corp New | APH | Information Technology | 0.07% |

| Discover Finl Svcs | DFS | Financials | 0.07% |

| Nvidia Corp | NVDA | Information Technology | 0.07% |

| Fiserv Inc | FISV | Information Technology | 0.07% |

| Fortune Brands Inc | FO | Consumer Discretionary | 0.07% |

| Range Res Corp | RRC | Energy | 0.07% |

| Constellation Energy Group | CEG | Utilities | 0.07% |

| Fmc Technologies Inc | FTI | Energy | 0.07% |

| Harley Davidson Inc | HOG | Consumer Discretionary | 0.07% |

| Sherwin Williams Co | SHW | Consumer Discretionary | 0.07% |

| Keycorp New | KEY | Financials | 0.07% |

| O Reilly Automotive Inc | ORLY | Consumer Discretionary | 0.07% |

| Altera Corp | ALTR | Information Technology | 0.07% |

| Whole Foods Mkt Inc | WFMI | Consumer Staples | 0.07% |

| Lauder Estee Cos Inc | EL | Consumer Staples | 0.07% |

| Aes Corp | AES | Utilities | 0.07% |

| V F Corp | VFC | Consumer Discretionary | 0.07% |

| Apollo Group Inc | APOL | Consumer Discretionary | 0.07% |

| Akamai Technologies Inc | AKAM | Information Technology | 0.07% |

| United States Stl Corp New | X | Materials | 0.07% |

| Bmc Software Inc | BMC | Information Technology | 0.07% |

| Xilinx Inc | XLNX | Information Technology | 0.07% |

| Campbell Soup Co | CPB | Consumer Staples | 0.07% |

| Autodesk Inc | ADSK | Information Technology | 0.07% |

| Limited Brands Inc | LTD | Consumer Discretionary | 0.07% |

| Comerica Inc | CMA | Financials | 0.07% |

| Fastenal Co | FAST | Industrials | 0.07% |

| M & T Bk Corp | MTB | Financials | 0.07% |

| Smucker J M Co | SJM | Consumer Staples | 0.07% |

| Nordstrom Inc | JWN | Consumer Discretionary | 0.07% |

| Davita Inc | DVA | Health Care | 0.07% |

| Denbury Res Inc | DNR | Energy | 0.07% |

| Molson Coors Brewing Co | TAP | Consumer Staples | 0.07% |

| Sigma Aldrich Corp | SIAL | Materials | 0.07% |

| Penney J C Inc | JCP | Consumer Discretionary | 0.07% |

| Ross Stores Inc | ROST | Consumer Discretionary | 0.07% |

| Genuine Parts Co | GPC | Consumer Discretionary | 0.07% |

| Waters Corp | WAT | Health Care | 0.06% |

| Vulcan Matls Co | VMC | Materials | 0.06% |

| Grainger W W Inc | GWW | Industrials | 0.06% |

| Linear Technology Corp | LLTC | Information Technology | 0.06% |

| Varian Med Sys Inc | VAR | Health Care | 0.06% |

| Harris Corp Del | HRS | Information Technology | 0.06% |

| Nrg Energy Inc | NRG | Utilities | 0.06% |

| Brown Forman Corp | BF.B | Consumer Staples | 0.06% |

| Xl Cap Ltd | XL | Financials | 0.06% |

| Darden Restaurants Inc | DRI | Consumer Discretionary | 0.06% |

| Hudson City Bancorp | HCBK | Financials | 0.06% |

| Mylan Inc | MYL | Health Care | 0.06% |

| Millipore Corp | MIL | Health Care | 0.06% |

| Ameren Corp | AEE | Utilities | 0.06% |

| International Game Technolo | IGT | Consumer Discretionary | 0.06% |

| Kimco Realty Corp | KIM | Financials | 0.06% |

| Wynn Resorts Ltd | WYNN | Consumer Discretionary | 0.06% |

| Wisconsin Energy Corp | WEC | Utilities | 0.06% |

| Plum Creek Timber Co Inc | PCL | Financials | 0.06% |

| Autozone Inc | AZO | Consumer Discretionary | 0.06% |

| Tiffany & Co New | TIF | Consumer Discretionary | 0.06% |

| Textron Inc | TXT | Industrials | 0.06% |

| Eqt Corp | EQT | Utilities | 0.06% |

| Family Dlr Stores Inc | FDO | Consumer Discretionary | 0.06% |

| Cerner Corp | CERN | Health Care | 0.06% |

| Red Hat Inc | RHT | Information Technology | 0.06% |

| First Solar Inc | FSLR | Industrials | 0.06% |

| Roper Inds Inc New | ROP | Industrials | 0.06% |

| Nabors Industries Ltd | NBR | Energy | 0.06% |

| Block H & R Inc | HRB | Consumer Discretionary | 0.05% |

| Electronic Arts Inc | ERTS | Information Technology | 0.05% |

| Prologis | PLD | Financials | 0.05% |

| Slm Corp | SLM | Financials | 0.05% |

| Allegheny Technologies Inc | ATI | Materials | 0.05% |

| Tyson Foods Inc | TSN | Consumer Staples | 0.05% |

| Centerpoint Energy Inc | CNP | Utilities | 0.05% |

| Health Care Reit Inc | HCN | Financials | 0.05% |

| Teradata Corp Del | TDC | Information Technology | 0.05% |

| Flowserve Corp | FLS | Industrials | 0.05% |

| Kla-Tencor Corp | KLAC | Information Technology | 0.05% |

| Hasbro Inc | HAS | Consumer Discretionary | 0.05% |

| Saic Inc | SAI | Information Technology | 0.05% |

| Jacobs Engr Group Inc Del | JEC | Industrials | 0.05% |

| Peoples United Financial In | PBCT | Financials | 0.05% |

| Airgas Inc | ARG | Materials | 0.05% |

| Microchip Technology Inc | MCHP | Information Technology | 0.05% |

| Owens Ill Inc | OI | Materials | 0.05% |

| Verisign Inc | VRSN | Information Technology | 0.05% |

| Mccormick & Co Inc | MKC | Consumer Staples | 0.05% |

| Mcafee Inc | MFE | Information Technology | 0.05% |

| Stericycle Inc | SRCL | Industrials | 0.05% |

| Polo Ralph Lauren Corp | RL | Consumer Discretionary | 0.05% |

| Windstream Corp | WIN | Telecommunication Services | 0.05% |

| Legg Mason Inc | LM | Financials | 0.05% |

| Advanced Micro Devices Inc | AMD | Information Technology | 0.05% |

| Masco Corp | MAS | Industrials | 0.05% |

| Dentsply Intl Inc New | XRAY | Health Care | 0.05% |

| American Intl Group Inc | AIG | Financials | 0.05% |

| Cf Inds Hldgs Inc | CF | Materials | 0.05% |

| Urban Outfitters Inc | URBN | Consumer Discretionary | 0.05% |

| Pitney Bowes Inc | PBI | Industrials | 0.05% |

| Watson Pharmaceuticals Inc | WPI | Health Care | 0.05% |

| Oneok Inc New | OKE | Utilities | 0.05% |

| Ball Corp | BLL | Materials | 0.05% |

| Newell Rubbermaid Inc | NWL | Consumer Discretionary | 0.05% |

| Northeast Utils | NU | Utilities | 0.05% |

| Expedia Inc Del | EXPE | Consumer Discretionary | 0.05% |

| Carefusion Corp | CFN | Health Care | 0.05% |

| Iron Mtn Inc | IRM | Industrials | 0.05% |

| Cincinnati Finl Corp | CINF | Financials | 0.04% |

| Cephalon Inc | CEPH | Health Care | 0.04% |

| Huntington Bancshares Inc | HBAN | Financials | 0.04% |

| Eastman Chem Co | EMN | Materials | 0.04% |

| Diamond Offshore Drilling I | DO | Energy | 0.04% |

| F M C Corp | FMC | Materials | 0.04% |

| Flir Sys Inc | FLIR | Information Technology | 0.04% |

| Quanta Svcs Inc | PWR | Industrials | 0.04% |

| Sears Hldgs Corp | SHLD | Consumer Discretionary | 0.04% |

| Marshall & Ilsley Corp New | MI | Financials | 0.04% |

| Cb Richard Ellis Group Inc | CBG | Financials | 0.04% |

| Torchmark Corp | TMK | Financials | 0.04% |

| Wyndham Worldwide Corp | WYN | Consumer Discretionary | 0.04% |

| Leucadia Natl Corp | LUK | Financials | 0.04% |

| Nisource Inc | NI | Utilities | 0.04% |

| Meadwestvaco Corp | MWV | Materials | 0.04% |

| Interpublic Group Cos Inc | IPG | Consumer Discretionary | 0.04% |

| Scana Corp New | SCG | Utilities | 0.04% |

| Scripps Networks Interact I | SNI | Consumer Discretionary | 0.04% |

| Assurant Inc | AIZ | Financials | 0.04% |

| Moodys Corp | MCO | Financials | 0.04% |

| Pall Corp | PLL | Industrials | 0.04% |

| Helmerich & Payne Inc | HP | Energy | 0.04% |

| Donnelley R R & Sons Co | RRD | Industrials | 0.04% |

| Zions Bancorporation | ZION | Financials | 0.04% |

| Avery Dennison Corp | AVY | Industrials | 0.04% |

| Equifax Inc | EFX | Industrials | 0.04% |

| Pactiv Corp | PTV | Materials | 0.04% |

| Pinnacle West Cap Corp | PNW | Utilities | 0.04% |

| Robert Half Intl Inc | RHI | Industrials | 0.04% |

| Dun & Bradstreet Corp Del N | DNB | Industrials | 0.04% |

| Gannett Inc | GCI | Consumer Discretionary | 0.04% |

| Cabot Oil & Gas Corp | COG | Energy | 0.04% |

| Pepco Holdings Inc | POM | Utilities | 0.04% |

| Devry Inc Del | DV | Consumer Discretionary | 0.04% |

| Pulte Group Inc | PHM | Consumer Discretionary | 0.04% |

| International Flavors&Fragr | IFF | Materials | 0.04% |

| Lsi Corporation | LSI | Information Technology | 0.04% |

| Sunoco Inc | SUN | Energy | 0.04% |

| Gamestop Corp New | GME | Consumer Discretionary | 0.04% |

| Allegheny Energy Inc | AYE | Utilities | 0.04% |

| Integrys Energy Group Inc | TEG | Utilities | 0.04% |

| Tellabs Inc | TLAB | Information Technology | 0.04% |

| Leggett & Platt Inc | LEG | Consumer Discretionary | 0.04% |

| Cintas Corp | CTAS | Industrials | 0.03% |

| Cms Energy Corp | CMS | Utilities | 0.03% |

| D R Horton Inc | DHI | Consumer Discretionary | 0.03% |

| Massey Energy Corp | MEE | Energy | 0.03% |

| National Semiconductor Corp | NSM | Information Technology | 0.03% |

| Teco Energy Inc | TE | Utilities | 0.03% |

| Constellation Brands Inc | STZ | Consumer Staples | 0.03% |

| Sealed Air Corp New | SEE | Materials | 0.03% |

| Abercrombie & Fitch Co | ANF | Consumer Discretionary | 0.03% |

| Bemis Inc | BMS | Materials | 0.03% |

| Coventry Health Care Inc | CVH | Health Care | 0.03% |

| Lexmark Intl New | LXK | Information Technology | 0.03% |

| Big Lots Inc | BIG | Consumer Discretionary | 0.03% |

| Goodyear Tire & Rubr Co | GT | Consumer Discretionary | 0.03% |

| Total Sys Svcs Inc | TSS | Information Technology | 0.03% |

| Molex Inc | MOLX | Information Technology | 0.03% |

| Supervalu Inc | SVU | Consumer Staples | 0.03% |

| E Trade Financial Corp | ETFC | Financials | 0.03% |

| Washington Post Co | WPO | Consumer Discretionary | 0.03% |

| Rowan Cos Inc | RDC | Energy | 0.03% |

| Lennar Corp | LEN | Consumer Discretionary | 0.03% |

| First Horizon Natl Corp | FHN | Financials | 0.03% |

| Patterson Companies Inc | PDCO | Health Care | 0.03% |

| Hormel Foods Corp | HRL | Consumer Staples | 0.03% |

| Nasdaq Omx Group Inc | NDAQ | Financials | 0.03% |

| Perkinelmer Inc | PKI | Health Care | 0.03% |

| Jabil Circuit Inc | JBL | Information Technology | 0.03% |

| Memc Electr Matls Inc | WFR | Information Technology | 0.03% |

| Jds Uniphase Corp | JDSU | Information Technology | 0.03% |

| Radioshack Corp | RSH | Consumer Discretionary | 0.03% |

| Snap On Inc | SNA | Industrials | 0.03% |

| Frontier Communications Cor | FTR | Telecommunication Services | 0.03% |

| Tenet Healthcare Corp | THC | Health Care | 0.03% |

| Novellus Sys Inc | NVLS | Information Technology | 0.03% |

| Apartment Invt & Mgmt Co | AIV | Financials | 0.02% |

| Ryder Sys Inc | R | Industrials | 0.02% |

| Metropcs Communications Inc | PCS | Telecommunication Services | 0.02% |

| Harman Intl Inds Inc | HAR | Consumer Discretionary | 0.02% |

| King Pharmaceuticals Inc | KG | Health Care | 0.02% |

| Qlogic Corp | QLGC | Information Technology | 0.02% |

| Novell Inc | NOVL | Information Technology | 0.02% |

| Federated Invs Inc Pa | FII | Financials | 0.02% |

| Janus Cap Group Inc | JNS | Financials | 0.02% |

| Teradyne Inc | TER | Information Technology | 0.02% |

| Dean Foods Co New | DF | Consumer Staples | 0.02% |

| Compuware Corp | CPWR | Information Technology | 0.02% |

| Monster Worldwide Inc | MWW | Information Technology | 0.02% |

| Nicor Inc | GAS | Utilities | 0.02% |

| Autonation Inc | AN | Consumer Discretionary | 0.02% |

| Tesoro Corp | TSO | Energy | 0.02% |

| Ak Stl Hldg Corp | AKS | Materials | 0.02% |

| Office Depot Inc | ODP | Consumer Discretionary | 0.02% |

| Eastman Kodak Co | EK | Consumer Discretionary | 0.02% |

| Titanium Metals Corp | TIE | Materials | 0.02% |

| U.S. Dollar | CASH_USD | Unassigned | 0.01% |

| Meredith Corp | MDP | Consumer Discretionary | 0.01% |

| New York Times Co | NYT | Consumer Discretionary | 0.01% |

Price Return vs. Total Return vs. Net Total Return

The S&P 500 index is generally quoted as a price return index, while also "total return" and "net total return" versions of the index exists; all three versions differ in how dividends are accounted for. The price return version does not account for dividends; it only captures the changes in the prices of the index components. The total return version reflects the effects of dividend reinvestment and the net total return version reflects the effects of dividend reinvestment after the deduction of withholding tax.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from S&P 500 Index to Dow Jones Index

Back from S&P 500 Index to Best Online Trading Site for Beginners home page