Safe Investing and Your Investment Risk Profile

Beginner investors are often looking for safe investing returning high yields at the same time. However, there is a definite relationship between risk and return.

Safe investing with high returns does not exist; if you are looking for higher yields, you will have to accept higher risk and vice versa, if you are keener to save investing, you will have to be good with lower returns. This relationship between risk and return is recognized by investors as risk/return trade-off.

Since majority of investors are similar in all looking for the highest possible returns, there is a big difference among them regarding risk tolerances. Much of the difference in risk tolerance stems from time horizon. That is, an investor with a short investment time horizon is less able to withstand losses. The remainder of the difference in risk tolerance is attributable to the risk investor can afford and is willing to accept, and investors experience. Volatility can be unsettling for many investors and they are more comfortable when they can avoid it.

To help determine your risk profile, which will help you make the right investment mix of safe investing and return for your situation, you should answer yourself the following questions.

Safe Investing And Financial Situation

How would you describe your current financial situation?

- Few financial commitments looking to accumulate wealth for the future (e.g. young single).

- Established financial commitments, not a lot of money at the moment but want to save more (e.g. young family).

- Well-established, finances are under control; want to save more and considering funding retirement.

- Preparing for retirement, thinking of downsizing home and strategies to release retirement funds.

- Retired, depend on investments and keen to maintain lifestyle.

How would you describe your present income?

- More than sufficient to cover my living expenses (I am able to save a certain amount every year).

- Sufficient to cover my living expenses (I am not able to accumulate my savings).

- Not sufficient to cover my living expenses (I need to supplement my income with returns on my investments).

How would you best describe your income expectations over the next five years?

- I expect my income to rise well ahead of inflation (through promotion, career developments, etc.).

- I expect my income to keep pace with inflation.

- I expect my income to fall (as a result of retirement, reduced working hours, etc.).

- My income fluctuates from year to year (such as self-employed investors).

Safe Investing And Time Horizon

What time horizon would you be comfortable with when investing?

- No specific time horizon, prepared to incur a loss upon redemption

- Less than 1 year

- 1 - 3 years

- 4 - 5 years

- 6 - 7 years

- 8 - 10 years

- 11 years or more

How long do you expect to take future withdrawals from your account?

- No specific time horizon

- I plan to take a lump sum distribution

- 1 - 3 years

- 4 - 5 years

- 6 - 7 years

- 8 - 10 years

- 11 years or more

Safe Investing And Risk Tolerance

What is your primary investment objective?

- Safety of money: I want to protect my principal and avoid any fluctuation in the value of my investments.

- Maintain a low level of risk: I would rather have a low rate of return while my capital should remain relatively stable.

- Balance a moderate return with a moderate risk of loss.

- High returns: I am willing to accept some fluctuation in my capital over the short term in exchange for higher returns over the long term.

- Highest possible returns: I want to achieve the highest possible long-term returns and willing to accept a higher degree of risk.

Which of these statements best describe your five years performance expectations?

- I need to see a positive return every year.

- I need to see at least a little return over the five years.

- I'd like to at least maintain my original investment.

- I can tolerate a small loss over the five years.

- I can tolerate significant losses over the five years for the potential of long-term gain.

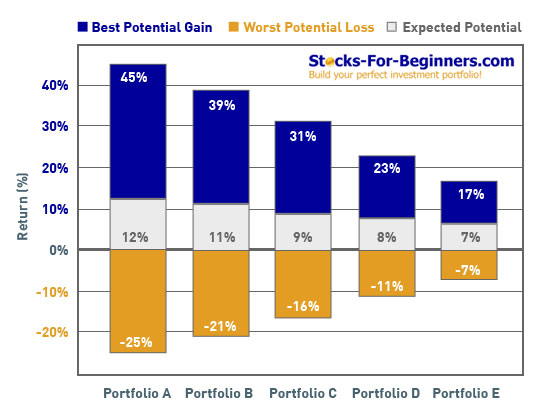

Which of these portfolios would you prefer to hold for the period of one year?

Which of the following portfolio volatilities would you be most comfortable with?

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Portfolio A | 5% | 5% | 5% | 5% | 5% |

| Portfolio B | -5% | 11% | 3% | 15% | -2% |

| Portfolio C | 10% | -10% | 8% | 0% | 20% |

| Portfolio D | 38% | -17% | -5% | 14% | 26% |

| Portfolio E | -15% | 18% | -28% | 63% | 32% |

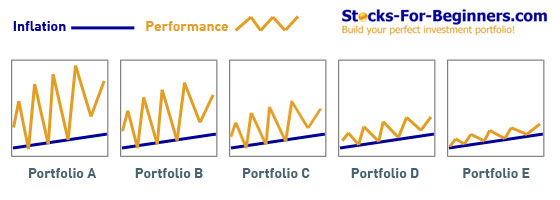

Which volatility pattern you are most comfortable with?

Which of the following best describes your attitude towards investment losses?

- I would check the value of my investments at least several times a month and feel very uneasy if I began to lose money.

- Daily losses make me uncomfortable, but are no cause for alarm. I would, however, start to feel very uneasy if I made a loss on my investments over a 12-month period.

- I take substantial day-to-day changes in my stride. However, I would start to feel very uneasy if I didn't recover any significant losses with a 1 to 2 year time frame.

- If my investments suffered significant losses over a two-year period and I still believed in my long-term strategy, I would remain fully confident of a recovery in performance.

What would you do if the value of your investment portfolio fell by 20%?

- I would immediately sell all the investment and move them to bank deposits.

- I would sell a portion of the investment and change to a more conservative portfolio.

- I would remain invested and follow the recommended strategy.

- I would increase the amount invested if possible because the market has become cheaper.

What is the highest loss you could withstand in one year before changing to a more conservative investment mix?

- -2%

- -5%

- -10%

- -25%

- -50%

Safe Investing And Investors Experience

What types of investment have you held in the past or do you currently hold?

- Cash and equivalents

- Bonds

- Large-cap stocks, ETFs, equity linked assurance schemes or mutual funds

- Small-cap stocks or REITs

- Emerging market stocks, commodities or ETNs

- Hedge funds or geared investment (options, futures, warrants, minis, forex)

How long have you been investing?

- Less than 1 year

- 1 - 4 years

- 5 - 10 years

- 11 years or more

Are you an experienced investor?

- Very experienced: I have used investments extensively in the past across different sectors and understand the factors that can influence performance; I am fully aware of the risks involved to gain high returns.

- Somewhat experienced: I have some basic knowledge of investment markets and have an understanding of how investment markets work and how returns can fluctuate.

- No experience at all: I am a beginner to stock market investing, not yet familiar with investments or financial markets.

Beginners Guide To Investing and 6 Typical Asset Allocation Profiles

Depending on your answers, one of our Beginners Guide To Investing 6 Typical Asset Allocation Profiles will be optimal for you.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Safe Investing to How to Invest in Stock

Back from Safe Investing to Best Online Trading Site for Beginners home page