Money Market Mutual Funds - Smart Investment or Stay Away?

There is a lot of money invested in money market mutual funds globally. Let's discover their advantages and reasons to or not to invest your money with them.

Let us first explain what exactly money market mutual funds are. They are mutual funds, which invest in low-risk securities with short duration, like for example Treasury Bills sold by the federal government. For you as investor, this investment should represent an alternative to money market saving account. Both investments are pretty much similar when it comes to their portfolio, which primarily consists of investments in corporate, government or municipal debt with maturities of less than 90 days. They represent safe, secure and liquid investment.

Money Market Mutual Funds vs. Money Market Savings Accounts

There are also some differences between MM savings accounts and MM mutual funds. For example, saving accounts are FDIC protected ($100,000 money market and $250,000 retirement), while you might get SIPC protection when you buy money market mutual fund via SIPC member firm - $500,000 portfolio and $100,000 cash (SIPC stands for Securities Investor Protection Corp.). Another interesting fact is that money market funds came in taxable and nontaxable forms; especially nontaxable variety and your personal tax bracket can be the reason to allocate your money with them. Money market savings accounts have some other specifics, like for example limitations regarding money withdrawals and cashing, which is explained in more detail in the money market investing article.

When to Invest in Money Market Mutual Fund and Factors to Watch when Picking One

Investors usually move their money to money market investments when they are in between investments, waiting for a good opportunity to come by. This way they earn at least some interests on their money while waiting. But since 2007, when the latest financial crisis started, it looks like things have pretty much changed. Because of extremely low interest rates many investors question themselves about the need for money market funds nowadays.

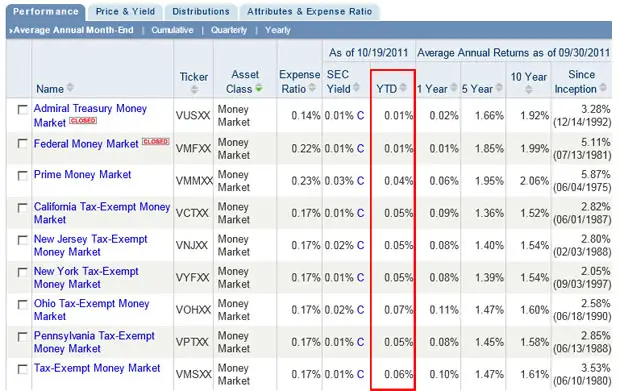

There are at least three things to bear in mind before investing in money market funds. First, these types of funds do have some costs (management fees and related), although low. Expense ratio used to be the most important factor when picking MM mutual fund, because it directly influences your return. The Vanguard funds family is the leader when it comes to low costs, as it is in many other areas.

Second, you as investor are naturally interested in current yield. This figure can be compared to interest rates paid on savings accounts. The higher the yield is, the higher is your return. At the moment interest rates on savings account are very low, but yield on money market funds are even lower or better say close to zero.

And third, inflation is present with prospects to even increase. With all the money printed in U.S. and globally to save the global economy (just remember QEI, QEII and probably QEIII on its way) on one side and imbalance of demand and supply in the commodities market, there are some real expectations about higher inflation rates in the future. Somehow rising gold prices are confirming that as well.

If you put these three variables into equitation, you get negative real return on your investment, which is probably not what you are looking for. This is one of the main reasons why some of the funds related to money market investments are closing their doors (for example PayPal Money Market Mutual Fund). In the image bellow you can find Morningstar money market mutual funds, including their YTD yield bordered with red color.

Source: Morningsar.com, 10/19/2011

Alternatives to money market funds in Low Interest Rates Environment

So the question is what are real alternatives to money market mutual funds in times of low interest rates? Well, the answer is bond funds. Yet again, not just any bond fund! Probably passive funds following some bond index and traded on the exchange (ETFs) will do better than actively managed mutual funds. Next, you have to consider the national or international bond portfolio; at the moment we would recommend diversifying to countries, which do not have debt issues - creditor nations. And third very important factor is currency diversification; short term dollar outlook isn't that bad, while its long-term prospects aren't that bright. This all drives us to searching for bond ETFs, exposed to emerging markets, which portfolios are valued in local currencies. This is a great topic for one of our next articles...

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Money Market Mutual Funds to Best Mutual Fund

Back from Money Market Mutual Funds to Best Online Trading Site for Beginners home page