Stock Market Performance - Business Cycle and Sector Rotation

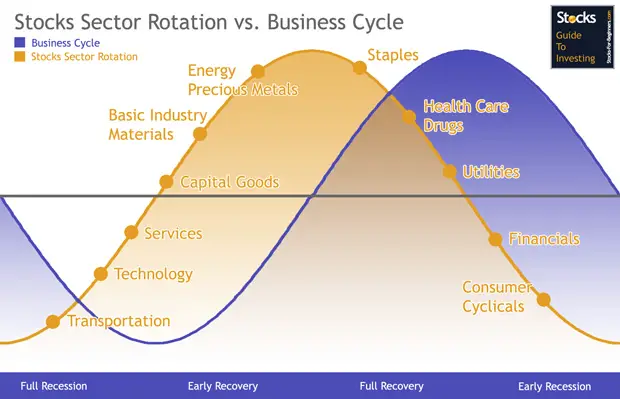

Stock market performance greatly depends on the timing and sector you invest in. We reveal which sectors you should invest in different economic cycles.

Portfolio managers often forget about the broad picture of stocks sector rotation according to the economic business cycle in their effort of searching for undervalued stocks. But if you will look at some statistical figures, stock picking has only small influence on the end portfolio return; it is far more important to be in the right sector at the right time, thus analyzing stocks environment, its pros and cons is crucial, especially for medium to long-term investors; day traders have totally different approach anyway.

4 Phases of Business Cycle

Every business cycle has 4 phases: Full Recession, Early Recovery, Full Recovery, and Early Recession. Your stock market performance depends on which sectors you will invest in each of these business cycles phases. What is also interesting and you have to be aware of it, that stocks cycle is a great leading indicator for business cycle, normally six to nine months ahead.

Full Recession

Full recession is marked by negative GDP for at least two or more subsequent quarters. This are heavy times for economy, companies and people spend less as they used to, business consequently works on reducing costs, also cutting of some workforce and unemployment rises. Central banks lower their key interest rates to give the economy access to cheaper money to finance the start of the business cycle again.

Transportation and technology stocks often lead the stocks in positive direction out of full recession.

Early Recovery

At this time states are facing huge, maybe even record unemployment rates, there is a decline in annual income and companies are dealing with overproduction. But at some point, the recession will hit the bottom and suddenly the GDP will stop declining and this is the point of early recovery. It can take week, but more often months or sometimes even years, before the economy get out of the recession.

At middle expansion phase, these sectors are followed by services, capital goods and basic industry/ materials.

Expansion - Full Recovery

When the economy is in its full expansion, real GDP grows, business begins to improve, and companies are hiring more workers and increase their orders of material from their suppliers. More employment causes more confident consumers, who start to spend more and this generates further business activity. Interest rates are rising normally at this time, to prevent high inflation rates.

Around the peak, the energy sector and consumer staples are the strongest factors of positive stock market performance.

Early Recession

At some point, the GDP will stop increasing and turn downwards again. Just before that, the employment, consumer spending and production will reach their highest levels. How long will the economy enjoy the benefits of good shape around the economy peak? Well, it could be for a very short or long period of time, just like with recession.

In times of early recession, health care/drugs and utilities sectors are the strongest, while the last sectors on top are consumer cyclical stocks and financials.

How About the Current Situation?

Two sectors recently on top were basic industry/materials and energy, both known as late cycle leaders and both caring inflationary expectations. This is a sign of upcoming stocks correction or a consolidation. We can expect that leadership in stocks will be taken over by drugs (health care) and staples/utilities stocks. And this is exactly what is happening on stock markets today. It might mean that a major top is forming, but is certainly suggests the change in market sentiment mode to more defensive, which is usually followed by market correction.

Conclusion

Researching the micro economy, such as analyzing the company fundamentals is ok before investing in stock. But you must be aware of the fact, that company's present and future earnings are much influenced by its business environment. By understanding the business cycle and stocks sector rotation you can anticipate a weaker or stronger economy and select the sectors to invest in. This way you can increase your stock market performance.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Stock Market Performance to Stock Market Basics

Back from Stock Market Performance to Best Online Trading Site for Beginners home page