Silver Fund ETFs - Comparison of Primary SLV Funds Backed by Physical Silver

Silver fund ETF represent a quick and easy way for an investor to gain exposure to the silver price. We have compared for you two primary silver fund ETFs: SLV and SIVR.

Silver fund ETF represent a quick and easy way for an investor to gain exposure to the silver price, without the inconvenience of storing physical bars (Silver Investing - Check Real-Time Streaming Chart And Historical Analysis Of Silver Price Movement). Some ETFs are backed with physical silver, while others invest in futures or precious metals mining companies. The most precise exposure to price movement of silver offer silver fund ETFs, which are also the most secure investment.

The value of silver, which is primarily driven by demand and supply in industry, is continuously rising in last few years together with other precious metals like gold. The main reason beside higher industry demand and limited supply are investors' concerns about declining purchasing power and inflation spur investment (Investing In Silver - Why You Should Be Investing In Silver?).

Two Primary Silver Fund ETFs Backed By Physical Silver

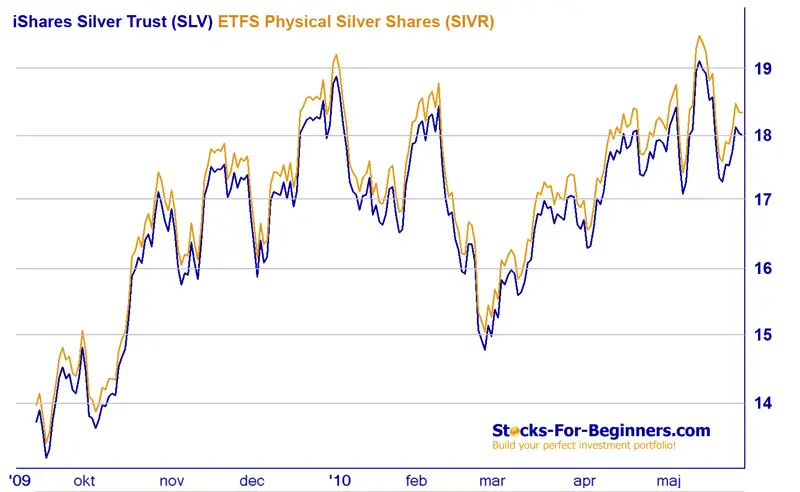

Two primary silver index ETFs exist, both are backed by physical silver and have the same objective: iShares Silver Trust (SLV) and ETFS Physical Silver Shares (SIVR).

Both are designed to track the price of silver net of trust expenses, both trades on the New York Stock Exchange Arca with minimum order size of 1 share, both are based on the price of an ounce of silver and both are eligible for margin and short selling. So where are the differences among them?

| Name | iShares Silver Trust | ETFS Physical Silver Shares |

|---|---|---|

| Inception Date | 04-21-2006 | 07-24-2009 |

| Symbol | SLV | SIVR |

| Estimated Expense | 0.50% | 0.45% (first year 0.30%) |

| Custodian | JPMorgan Chase Bank, London branch | HSBC Bank USA |

| Prospect | http://us.ishares.com/ | http://www.etfsecurities.com |

| Average Daily Volume (52-week) | 11,031,467 | |

| Price (06-02-2010) | $17.98 | $18.30 |

| Market Capitalization | $5,430,000,000 | $148,230,000 |

Source: ETFs Prospects, ETFs WebSites & Google Finance

Direct Comparison Of ETFs

Performance

SLV and SIVR both perform almost exactly the same, which is very close to silver itself. You can check Real-Time charts on Google Finance.

Assets

While SLV may be the largest physical silver fund ETF with $5.4 billion in assets at the beginning of June 2010, it is not the only U.S. ETF to be backed by physical silver holdings. SIVR had $148.2 million in assets on the same date. But it has to be noted, that SIVR just started its operation on 07-24-2009 (not even a full year on the market), while SLV is present on the market already for 4 full years, since 2006.

Trading Volume

SLV is the largest fund when measured by assets and also has the highest trading volume. SLV 52-weeks average daily trading volume is more than 11 million shares. SIVR has a 52-weeks average daily trading volume of around 160,000 shares, which represents a daily turnover of less than $3 million (160,000 * 18). SLV daily turnover is much higher at current prices, almost $200 millions.

Liquidity is an important factor when deciding between similar ETF funds. Since SIVR is relatively new silver fund, it has accordingly low trading volume. An average investor should not have difficulty trading in or out of any of these two funds, while major players on the market should stick to SLV until the new fund is more established.

Management Fees

SLV and SIVR differentiate strongly in their management fees structure and schedule. While SLV has a management fee of 0.5%, the newcomer SIVR has only 0.3% fee for the first year and afterwards 0.45%. Both funds offer investors exposure to a physical stockpile of silver held for investors by the trust. For average investor the difference in management fees can be a deciding factor. Investors who are comfortable with only the biggest funds might choose SLV instead.

Silver Storage Location

The most noticeable difference between SLV and SIVR is in custodian. The custodian is responsible for safekeeping the silver owned by the trust. While SLV is using the London branch of JPMorgan Chase Bank as custodian, ETFS is using HSBC Bank in U.S. It is to notice that no Exchange-Traded fund has failed so far because of counterparty risk, but the reassertion of counter-party risk through last financial crisis is driving much of the risk in the current markets. ETF's cannot protect you in case of custodian or sub-custodian failure for example.

Auditor Inspection

Auditor inspection is extremely important part for ETFs investors, to be sure, that Trust is really backed up with all the silver bullions as it should be according to the prospect. Otherwise, you as silver fund SLV investor (1) owns the iShares (2), which are issued by the Trust (Bank of New York) (3), which hires a Custodian (JPM Chase Bank) (4), which can have any number of Sub-Custodians, Agents or Depositories (5), where the silver (6) might be held. You as investor are probably not willing to take such risk compared to physical silver owner (1), who owns and controls his own silver (2).

SLV inspection rights are very poor, since they permit examine on custodian premises, where the silver bullions are held, only upon at least ten days prior notice; besides, the custodian does not have to prove that silver held by a sub-custodian actually exists.

SIVR inspection takes place two times a year. One is yearend and the other is a random date. The inspection is conducted by the world renowned bullion assayers Inspectorate International.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Related Articles

Commodity ETF - Opportunity or Threat?

Commodity ETF (Exchange Traded Fund) has been quickly gaining popularity in last couple of years while giving private investors chance to expose to commodities.

Gold Index ETFs - Comparison of Primary Gold Funds Backed by Physical Gold

We have compared for you three primary gold index ETFs backed by physical gold: SPDR Gold Shares (GLD), ETFS Physical Swiss Gold Shares (SGOL) and iShares COMEX Gold Trust (IAU).

Back from Silver Fund to Commodities Market

Back from Silver Fund to Best Online Trading Site for Beginners home page