Contrarian Investing Strategy - Profit From Wrong Conventional Wisdom

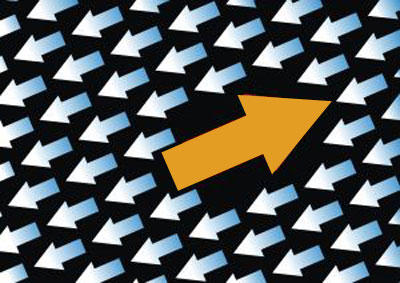

Contrarian investing is a powerful investment strategy, focusing on undervalued stocks in extreme market sentiment situations, when the majority is wrong.

Contrarian investing is based on the psychology of going against the crowd, but be careful, not at any price and definitely not all the time! A contrarian does not necessarily have a negative view of the overall stock market, nor does he have to believe that it is always overvalued, or that the conventional wisdom is always wrong. Going blindly against the crowd can burn your fingers, since the majority of investors are usually right.

True contrarians look for points of maximum exuberance or despair, which is when the majority is generally wrong; contrarian investors focus not only on the general sentiment, but more importantly on how that sentiment can lead to disconnects between fundamentals and expectations. The contrarian investor may choose to focus on an industry that is not in favor right now, and make an investment in a company within that industry that is stable and doing very well. By choosing to invest in overlooked businesses that are part of an unpopular market sector, the investor stands a good chance of making a significant return on the investment while facing little to no competition for acquiring stocks.

Contrarian trading strategy can take place in both a bull market and a bear market. The key for the investor who employs this strategy is to know when to anticipate a bubble in the market and make arrangements to sell, while at the same time choosing to buy during periods when the market is characterized by a high level of pessimism. This is going against the grain of the market and can be very risky. At the same time, the rewards can be significant.

While contrarian investing seems to be based more on instinct than factual information, this is rarely the case. The concept of contrarian investing usually entails careful research into what the majority of investors are doing and then choosing to look for areas of the market that are being neglected. Once these areas are identified and evaluated, it is possible to determine if there is a significant chance of making a profit by going in the opposite direction of most of the current market indicators. Far from relying on instinct alone, contrarian investing requires the application of logic, gathering of facts, and carefully weighing the chance of return against the potential for risk.

Contrarian vs. Value Investing

Contrarian investment strategy is related to value stock investing in that the contrarian is also looking for mispriced investments and buying those that appear to be undervalued by the market. The distinction between both investment strategies is that a value stock can be identified by financial metrics such as the book value or P/E ratio. A contrarian investor may look at those metrics, but is also interested in measures of "sentiment" regarding the stock among other investors, such as sell-side analyst coverage and earnings forecasts, trading volume, and media commentary about the company and its business prospects.

Contrarian Investing Indicators

Volatility Index (VIX)

Volatility index VIX also known as "Fear index" is commonly used contrarian indicator, which is measuring investor sentiment by tracking the prices of financial options, giving a numeric measure of how pessimistic or optimistic market actors are. A low number in this index indicates a prevailing optimistic or confident investor outlook for the future, while a high number indicates a pessimistic outlook. By comparing the VIX to the major stock-indexes over longer periods of time, it is evident that peaks in this index generally present good buying opportunities.

Short Interest

One institutional indicator that bears watching is short interest, which measures the amount of betting that the market will fall. It can happen that money managers will accumulate shorts, but if the trend will not change in a short-period of time, they will be forced to cover their short positions and buying stocks - bullish in the short term, but a mildly worrisome long-term contrarian indicator.

Institutional Investors Outlook

Another sentiment that indicates wariness - but not panics or euphoria, are investors intelligence surveys among institutional investors on their outlook. You shouldn't worry until the percentage of bullish managers is above 60%. You should also consider the percentage of bearish managers; if the number is very low (below 20% for example), this is somewhat troubling.

Mutual Fund Cash Levels

Mutual fund cash levels are another sentiment indicator. Fund managers keep a percentage of their assets in money market securities, or cash, to meet redemptions. When they're worried about a market decline, they raise their cash levels. When they're bullish, they keep cash levels low.

Mutual Funds Inflows

The behavior of individual investors is another powerful indicator. You should follow where mutual fund investors are putting their money. If in one month for example $20 billion goes into stock funds vs. $80 billion in bond funds, this is powerful information telling you a lot about the sentiment of individual investors.

Newspapers And Magazines

Finally, you have less precise indicators, such as the covers of general-interest news magazines, such as Time and Newsweek. When the stock market is so interesting it bumps regular topics off the cover, then the market is overheated indeed. But you should keep in mind that sentiment indicators are the most ephemeral of all stock market indicators, and best viewed in hindsight. If you're a long-term investor, you shouldn't worry until your neighbor sells his house to buy Microsoft.

Contrarian Investment Strategies

High Dividend Stocks

Another example of a simple contrarian strategy is purchasing the stocks in the Dow Jones Index that have the highest relative dividend yield. These stocks often have high yields not because dividends were raised, but rather because their share prices fell - could be because the company is experiencing difficulties, or simply is at a low point in their business cycle. By repeatedly buying such stocks, and selling them when they no longer meet the criteria, you can build a successful investing strategy.

The Forgotten Asset Classes

When the Dot com bubble started to deflate, an investor would have profited by avoiding the technology stocks that were the subject of most investors' attention. Asset classes such as value stocks and real estate investment trusts were largely ignored by the financial press at the time, despite their historically low valuations, and many mutual funds in those categories lost assets. These investments experienced strong gains amidst the large drops in the overall US stock market when the bubble unwound.

Shorting Overvalued Stocks

Another contrarian investing strategy, although more dangerous, is shorting overvalued stocks. This requires 'deep pockets' in that an overvalued security may continue to rise, due to over-optimism, for quite some time. Eventually, the short-seller believes, the stock will 'crash and burn'.

Mutual Funds With Contrarian Investment Strategy

If you like the idea of contrarian investing but you would not like to do it on your own, you can choose among few mutual funds with contrarian investing strategy:

- Dreman Contrarian Small Cap Value, DRSVX

- Janus Contrarian Fund, JSVAX

- Columbia Contrarian Core, SMGIX

- Fidelity Contrafund, FCNTX

From year 2000 to 2010 they were all strongly outperforming their benchmarks and S&P 500 index.

Recommended Reading - Recommended Reading - Recommended Reading - Recommended Reading

If Contrary Investing Is So Good, Why Doesn't Everyone Do It?

Well, if everyone did it, then it would not work because there would be fewer panics and speculative orgies. Second, it can be very uncomfortable to be wrong and contrary at the same time: the humiliation of going against the crowd when the crowd is right - and that can happen - is devastating. And third, much of our training and socialization teach us that the majority is right or at least, that it rules: contrarians are out of step or at least did not get that message when they were growing up.

Written by: Goran Dolenc

Do you find this content useful? Like! Tweet! Recommend! Share!

Back from Contrarian Investing to Stock Market Trade

Back from Contrarian Investing to Best Online Trading Site for Beginners home page